Advertisement|Remove ads.

AMC Entertainment Stock Slides Ahead Of Q4 Print Amid Macro Concerns But Retail Gears For Hit Performance

Movie theater chain AMC Entertainment Holdings, Inc. (AMC) is scheduled to release its fiscal year 2024 fourth-quarter results after the closing bell on Tuesday

The Finchat-compiled consensus estimate calls for a narrower loss of $0.16 per share and revenue of $1.30 billion, compared to the year-ago loss of $0.54 per share and revenue of $1.10 billion.

The estimated year-over-year revenue (YoY) growth of 17.3% marks an acceleration from the third quarter’s 11.5% growth.

Last week, rival Cinemark Holdings, Inc. (CNK) reported record fourth-quarter revenue and a return to profit, citing better-than-expected industry performance. It also reinstated its annual cash dividend, which was suspended in April 2020 after the COVID-19 pandemic. However, the bottom-line miss spooked investors, sending its shares lower.

Earlier this month, Roth MKM analyst Eric Handler upgraded AMC stock to ‘Neutral’ from ‘Sell’ but trimmed the price target to $3.25 from $4. The analyst said AMC shares could be at or near their bottom due to several positive events.

Handler noted that the box office was entering a two-year content cycle. He added that AMC’s operating cash flow will likely turn positive in 2025 and that the company continues to reduce debt and extend debt maturities.

According to the analyst, AMC’s risk-reward seems more balanced than in the last five years.

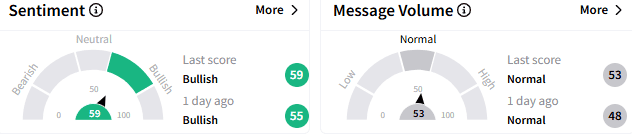

On Stocktwits, sentiment toward AMC stock stayed 'bullish' (59/100), but the message volume remained at a ‘neutral’ level.

A bullish watcher said the stock could scale the $5-barrier after the quarterly earnings release.

Another watcher expressed confidence in the long-term prospects of the stock.

AMC is among the stocks that rallied hard during the meme frenzy's peak in 2021. This is despite the company’s fundamentals faltering due to the theater closures forced by the COVID-19 pandemic.

The stock capitalized on its meme credentials and soared as high as $726.20 on a reverse split-adjusted basis in mid-2021, and CEO Adam Aron used it to the company’s advantage by raising equity capital.

The box office has been recovering from its post-COVID-19 slump. Box Office Mojo estimates put fourth-quarter domestic ticket sales at $2.35 billion, up 26.5% year over year. The top movie during the quarter was “Wicked,” which grossed $432.94 million.

AMC stock fell 4.5% to $3.21 in early afternoon trading, with the broader market weakness triggered by a weak consumer confidence reading denting sentiment toward the stock.

The stock has fallen over 15% so far this year. It has traded in a 52-week range of $2.38-$11.88.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)