Advertisement|Remove ads.

Salesforce Stock Receives Price Target Cut Ahead Of Wednesday's Q4 Print - Retail Eyes Rally Reacceleration

Salesforce, Inc. (CRM) stock showed tentativeness in Tuesday’s premarket session after an analyst reduced the price target and chose to stay on the sidelines.

Citi analyst Tyler Radke lowered the price target for Salesforce stock to $350 from $390 and maintained a ‘Neutral’ rating, TheFly reported. The development comes ahead of the company’s fourth-quarter results for the fiscal year 2025, which are due after the market closes on Wednesday.

Citing channel checks, Radke said demand trends for Salesforce remained mixed during the quarter. The analyst noted that Agentforce activity remained robust but the company had to hand out heavy discounts to drive adoption. Agentforce is Salesforce’s autonomous artificial intelligence (AI) agent.

While the analyst expects the company to meet the fourth-quarter consensus estimates and the first-quarter outlook to be positive, he sees revenue and bookings growth remaining constrained in the high single digits.

On the other hand, Wedbush analyst Daniel Ives said he believes the consensus estimates of $2.61 in earnings per share (EPS) and $10.04 billion in revenue are conservative, given the current pace of AI monetization within the Salesforce ecosystem.

According to the analyst, the company is making significant strides in integrating AI into its broader CRM suite, which will likely fuel major collaboration deals.

Ives has an ‘Outperform’ rating and a $425 price target for Salesforce stock.

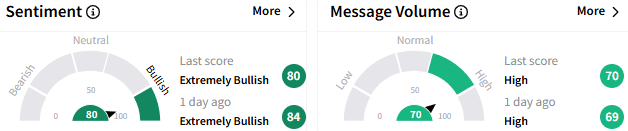

On Stocktwits, retail sentiment toward Salesforce stock remained ‘extremely bullish’ (80/100), and the message volume stayed at a ‘high’ level.

A bullish user positioned for a stock move toward $366, anticipating solid earnings from the company.

Salesforce stock slipped 0.35% to $307.25 in premarket trading, although it is down over 10% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)