Advertisement|Remove ads.

Retail Gets Strongly Bullish On AMD Ahead Of Q3 Earnings Release, Stock Climbs

Advanced Micro Devices, Inc. ($AMD) is scheduled to report its third-quarter results after the market closes and the stock climbed more than 3% ahead of its earnings release.

The Santa Clara, California-based chipmaker’s earnings assume importance, given its exposure to the artificial intelligence technology, but it is still playing catchup to frontrunner Nvidia Corp. ($NVDA)

Analysts, on average, expect AMD to report earnings per share (EPS) of $0.91 and revenue of $6.71 billion for the quarter. This compares to the year-ago EPS of $0.70 and revenue of $5.8 billion.

The chipmaker’s guidance issued along with its second-quarter results in late-July calls for revenue of $6.7 billion, plus or minus $300 million, and non-GAAP gross margin of about 53.5%.

Morgan Stanley semiconductor analyst Joseph Moore noted green shoots of recovery in the traditional server market even as AMD looks ahead to the ramp-up of Turin Zen 5-based EPYC server processors.

On the other hand, the outlook for AI and personal computers is mixed, he said.

Moore sees modest upside to AMD’s data center revenue guidance of $4.5 billion for the full year. “Customers are committed to AMD as a viable alternative to NVIDIA, but it remains more of an investment phase,” he added.

Morgan Stanley’s muted outlook for PC processors aligns with data from IDC, which showed that traditional PC shipments fell 2.4% year-over-year (YoY) to 68.8 million units in the third quarter. This marked a reversal from the 3% growth witnessed in the second quarter.

IDC attributed the slackness to rising costs and cooling off of inventory replenishment seen in the second quarter.

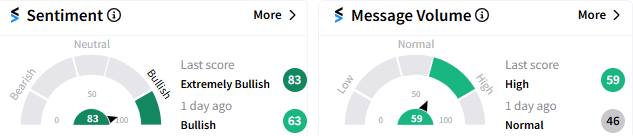

On Stocktwits, sentiment toward the stock turned ‘extremely bullish’ (83/100) from ‘bullish’ a day ago, with message volume rising to ‘high.’

The stock was among the top 20 trending stocks on Stocktwits.

As of 2:25 pm ET, AMD stock surged up 3.13% to $164.93.

The stock has gained merely 8.5% year-to-date, underperforming peer Nvidia, which is up a whopping 184%.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1836899973_jpg_3131fc01af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anavex_jpg_c0e70c2f1e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_90354aa51a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246572978_jpg_f2bcc700c5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)