Advertisement|Remove ads.

AMD Stock Swings Wildly Pre-Market On Price Target Cut Ahead Of Q4 Earnings: Retail Divided

Advanced Micro Devices’ (AMD) pre-market jump of nearly 2% on Tuesday reversed after Morgan Stanley lowered its price target on the stock, ahead of the company’s fourth-quarter earnings report scheduled for release after the market close.

At the time of writing, the stock was holding onto gains of just under 1%.

The brokerage lowered its price target on AMD from $158 to $147 while maintaining an 'Equal Weight' rating, citing tempered expectations for AI-related growth.

The analyst noted that while subdued AI forecasts might be beneficial in the near term, the next major growth catalysts appear to be further down the line, adding that robust server demand is expected to support earnings.

Retail investors will be focused on how AMD is navigating Big Tech's growing shift towards custom silicon, which has raised questions about the company’s competitive position in the AI infrastructure market.

The rapid progress of Chinese AI startup DeepSeek will also be weighing on retail minds.

The reported development of AI models capable of matching or surpassing Western counterparts at lower costs has sparked concerns over the sustainability of the heavy AI infrastructure spending that has fueled rallies for chipmakers like AMD.

Analysts expect AMD to report earnings of $1.09 per share for Q4.

Revenue is expected to hit $7.5 billion, marking a 22% increase year-over-year.

Full-year earnings are projected at $3.32 per share on revenue of $25 billion, representing a 13% growth compared to 2023.

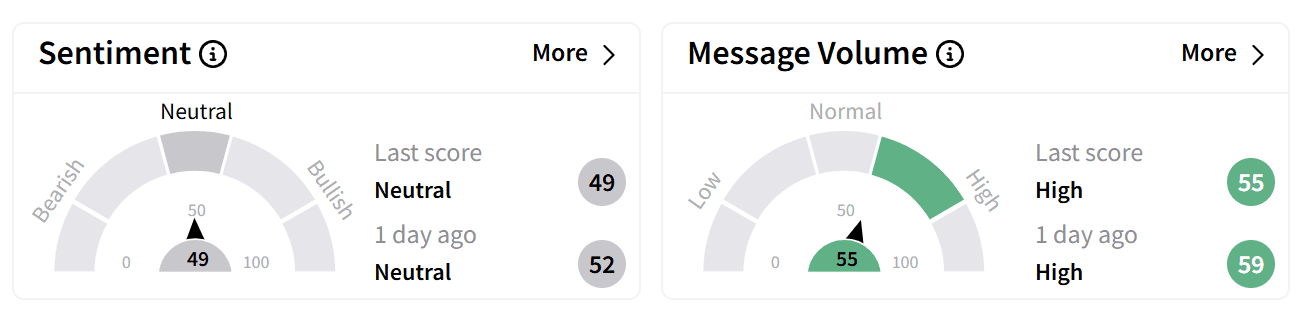

On Stocktwits, retail sentiment was ‘neutral’ accompanied by ‘high’ levels of chatter ahead of AMD's Q2 earnings.

One user speculated that negative news and recent downgrades are already factored into the stock price, suggesting that a positive earnings surprise could push the stock to $140, a potential upside of over 21%. Some bullish forecasts even target $150.

Other users were more pessimistic, expecting lower guidance that could cause the stock price to dip further.

AMD's stock is down more than 36% over the past year, with a year-to-date decline exceeding 6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Amcor Stock Climbs Pre-Market Despite Q2 Revenue Miss, Profit Decline: Retail Sentiment Improves

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)