Advertisement|Remove ads.

Amcor Stock Climbs Pre-Market Despite Q2 Revenue Miss, Profit Decline: Retail Sentiment Improves

Amcor PLC (AMCR) stock rose around 1.3% in pre-market trade on Tuesday after the company reaffirmed its guidance for 2025 despite a revenue and profit decline in the second quarter of 2025.

The packaging giant posted earnings per share (EPS) of $0.16, in line with analyst expectations, according to Koyfin.

Revenue, however, fell short of forecasts, coming in at $3.24 billion compared to the $3.36 billion consensus estimate. This marked a 4% year-over-year decline.

Net profit dropped around 28% to $163 million compared to the same period last year.

Despite the downturn, Amcor reaffirmed its fiscal 2025 guidance, projecting EPS between $0.72 and $0.76 and adjusted free cash flow between $900 million and $1 billion.

CEO Peter Konieczny highlighted the strategic benefits of Amcor's planned merger with Berry Global, emphasizing its potential to enhance customer value and shareholder returns.

“Bringing these two companies together will deliver on our strategy to become an even stronger company with accelerated volume-driven organic growth achieved through an unwavering focus on our customers, sustainability and portfolio mix,” he said in a statement.

The added that the combined company will have stronger positions in key markets and offer a more comprehensive range of packaging solutions for both consumer and healthcare sectors.

“With faster growth and $650 million of identified synergies, this combination will drive significant near and long term value for all shareholders,” he added.

The merger is expected to close by mid-2025.

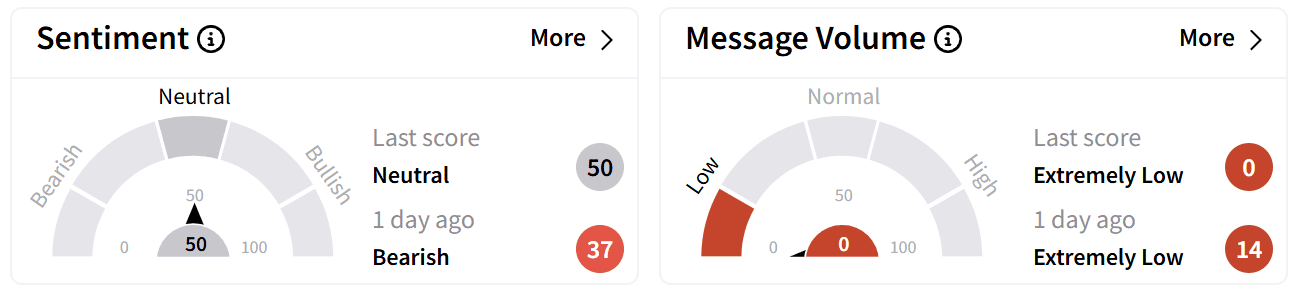

On Stocktwits, retail sentiment around Amcor improved to 'neutral' from 'bearish,' though chatter remained 'extremely low' as the earnings report failed to generate significant excitement among retail investors.

Amcor's stock has gained 2.5% over the past year and is up 1.5% so far in 2025.

Tuesday's pre-market gains will effectively double the company's year-to-date increase.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ball Stock Gains Pre-Market Despite Mixed Q4 Earnings: Retail Neutral

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)