Advertisement|Remove ads.

American Airlines, JetBlue Abandon Alliance Revival Efforts: Retail Traders Eye Next Moves

American Airlines (AAL) and JetBlue (JBLU) stocks garnered retail attention on Monday after the companies ended discussions for a potential revival of their partnership.

The companies were in talks about a tie-up after their previous partnership, the Northeast Alliance, was dissolved following a non-jury trial that found it had violated federal antitrust law.

“Although we proposed a very attractive proposition to JetBlue and its customers and team, it became clear over time that JetBlue was focused on different business priorities,” American Airlines’ Chief Strategy Officer Steve Johnson said in a letter to staff.

The two companies had decided to form the NEA in 2020, and the U.S. Transportation Department had approved the partnership towards the end of President Donald Trump's first term in January 2021.

Through the partnership, American Airlines was looking to gain market share in New York City, where it has struggled in the past.

The company also filed a lawsuit against JetBlue over the winding down of the NEA.

According to a Bloomberg report, JetBlue said that it was making “good progress” in talks with multiple airlines about a new partnership, and may announce a deal in the second quarter.

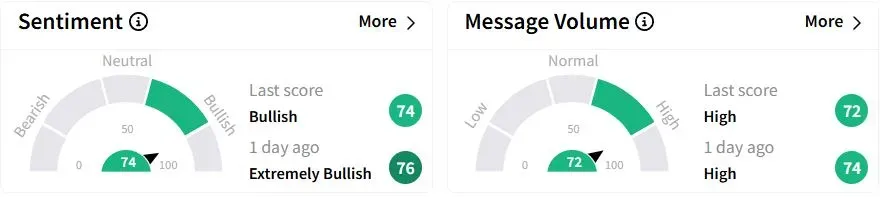

Retail sentiment about American Airlines on Stocktwits moved to ‘bullish’ (74/100) territory from ‘extremely bullish’(76/100) a day ago, while retail chatter was ‘high.’

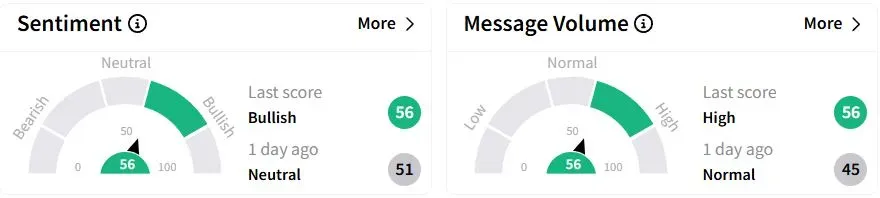

Retail sentiment about JetBlue moved to ‘bullish’ (56/100) territory from ‘neutral’(51/100) a day ago, while retail chatter was ‘high.’

One retail trader suggested that “something was brewing” and a deal with United Airlines could be on the cards for JetBlue.

Last week, American Airlines dropped its full-year forecast amid economic uncertainty stemming from tariffs.

JetBlue is scheduled to report its results on Tuesday.

American Airlines shares have fallen 43.4% while JetBlue shares are down 48.5% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)