Advertisement|Remove ads.

American Tower’s Upbeat Q4 Fails To Lift Retail Morale: CEO Notes Challenging Macro Environment But Says Demand Remains Robust

American Tower Corp. (AMT) shares drew retail attention on Stocktwits after the company’s fourth-quarter earnings exceeded Wall Street expectations.

Revenue rose 3.7% year over year (YoY) to $2.55 billion, higher than a Street estimate of $2.51 billion. Adjusted Funds From Operations (AFFO) attributable to common stockholders stood at $2.3 compared to an estimated $1.98. Net income shot up to $1.23 billion during the quarter.

During the quarter, the company’s distributions per share stood at $1.62, amounting to $757.1 million—a decline of 4.7% from last year.

For 2025, American Tower projected AFFO attributable to AMT common stockholders per share at $10.31 to $10.50.

At the end of 2024, the company had approximately $12 billion of total liquidity, comprising roughly $2 billion in cash and cash equivalents plus the ability to borrow an aggregate of approximately $10 billion under its revolving credit facilities, net of any outstanding letters of credit.

CEO Steven Vondran said the firm’s initial expectations for accelerating activity over the course of the year were validated, highlighted by mid-band deployments in the U.S. and Europe, 4G densification and early 5G upgrades in emerging markets, and another exceptional year of leasing at CoreSite.

“While the macroeconomic environment remains challenging, demand for connectivity across our global platform continues unabated,” he said.

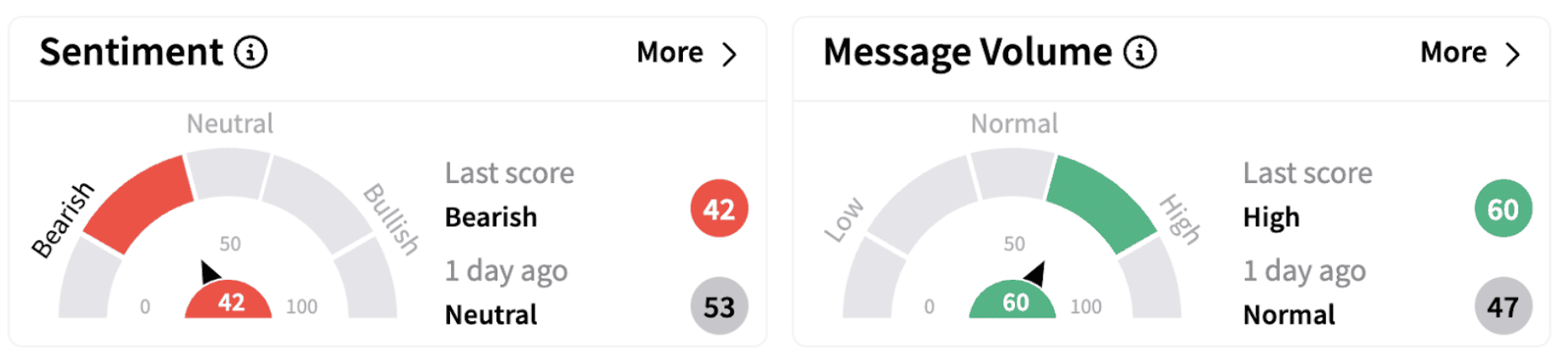

On Stocktwits, retail sentiment dipped into ‘bullish’ territory despite the company's positive outlook. The move was accompanied by ‘high’ retail chatter.

American Tower stock has gained over 6% in 2025 and is up just over 2% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)