Advertisement|Remove ads.

Amicus Therapeutics, ShiftPixt, Blackstone: Retail Investors Turn Most Bullish On These 3 Stocks

FOLD

Shares of Amicus Therapeutics (FOLD) rose by 14% on Thursday after the company made a deal with Teva Pharmaceuticals to settle their patent dispute. Teva wanted to sell a generic version of Amicus' drug GALAFOLD before its patent expired.

According to the agreement, Teva can start selling the generic version in the U.S. in 2037, if it gets approved by the FDA. Both companies have agreed to drop all legal cases related to this issue.

BofA raised its price target for Amicus shares to $15 from $13 while maintaining its ‘Buy’ rating on the stock. BofA sees this as a positive step since other similar legal cases with Aurobindo and Lupin are still unresolved. The settlement also eases worries that investors had about the ongoing legal risks.

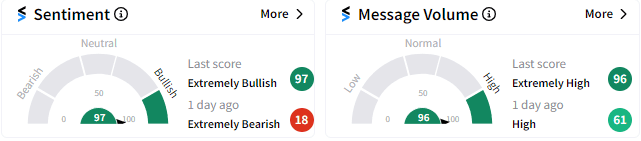

Retail sentiment on Stocktwits has flipped to ‘extremely bullish’ (97/100) from ‘extremely bearish’ just a day ago.

PIXY

Shares of ShiftPixy Inc (PIXY) jumped 78% on Thursday after the national staffing enterprise announced the acquisition of TurboScale, an AI technology company specializing in scalable GPU cloud infrastructure and AI model deployment.

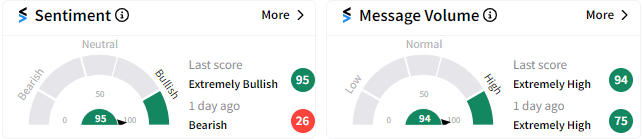

PIXY became the top trending ticker on Stocktwits on Thursday morning after the announcement. Retail sentiment around the stock is more ‘extremely bullish’ (95/100) from ‘bearish’ a day ago.

BX

Blackstone shares soared 7% on Thursday after the firm posted third-quarter earnings that surpassed Wall Street expectations.

Wells Fargo has maintained its ‘Overweight’ rating on the stock and set a price target of $169. The brokerage noted that while Blackstone's Q3 earnings per share (EPS) were better than expected, the improvements were of "fairly low quality," mainly due to favorable changes in the tax rate and other less reliable factors.

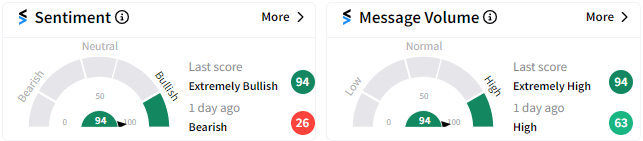

Retail sentiment on Stocktwits has shifted to ‘extremely bullish’ (94/100) from ‘bearish’ a day ago.

For updates and corrections email newsroom@stocktwits.com.

Read more: TSMC Stock Surges Pre-Market, Lifting Apple and Nvidia After Quarterly Profit Jump – Retail Rejoices

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)