Advertisement|Remove ads.

TSMC Stock Surges Pre-Market, Lifting Apple and Nvidia After Quarterly Profit Jump – Retail Rejoices

Shares of Taiwan Semiconductor Manufacturing Company Ltd (TSM) rose more than 8% pre-market on Thursday after beating Wall Street estimates for third-quarter earnings.

The company posted a 54% increase in profits, driven by surging demand for AI-related chips, and delivered a strong outlook for the next quarter.

As the world's top producer of advanced semiconductors, TSM’s performance has also boosted its key clients, with Nvidia rising 2.5% and Apple up 0.5% in pre-market trading. TSM’s quarterly revenue reached $23.5 billion, marking a 39% year-over-year increase and beating analyst forecasts.

“Our business was supported by strong smartphone and AI-related demand of our industry-leading 3nm and 5nm technologies,” TSM said in its earnings report, noting that North America accounts for 71% of its net revenue.

The Taiwan-based company posted a third-quarter profit of $10.06 billion, exceeding analyst estimates of $9.43 billion, with earnings per share (EPS) of $1.94, higher than the expected $1.79. TSM attributed the profit surge to high capacity utilization and cost efficiencies.

Looking ahead, TSM forecasts continued growth, with fourth-quarter revenue guidance between $26.1 billion and $36.9 billion.

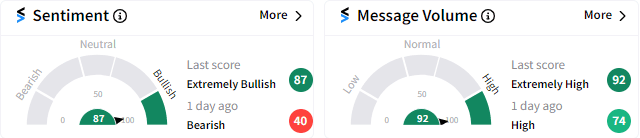

Retail sentiment on Stocktwits has flipped to ‘extremely bullish ‘ (87/100) from ‘bearish’ after the company’s forecast contradicted ASML’s bearish outlook that shook technology stocks on Tuesday.

TSM’s shares have soared nearly 100% in 2024 so far and 124% in the last 12 months.

($1 = NT $32.14)

For updates and corrections email newsroom@stocktwits.com.

Read more: Nvidia Stock Recovers While Apple, Microsoft Still Struggle After ASML Shock: Retail Sentiment Stays Weak

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)