Advertisement|Remove ads.

Analog Devices Q1 Earnings Expected To Decline As Industrial Demand Faces Macro Headwinds, But Retail’s Bullish

Analog Devices Inc. (ADI) shares will be on investors’ radar heading into Wednesday as the semiconductor player is all set to announce its first-quarter (Q1) results.

The Massachusetts-based chipmaker is estimated to post earnings per share (EPS) of $1.54 in Q1, down from $1.71 during the same period last year. Its revenue is also expected to decline to $2.36 billion from $2.5 billion a year ago.

ADI has beaten earnings and revenue estimates for the past four quarters. It remains to be seen if it can do the same in Q1.

Sluggish demand across ADI’s key business segments – industrials and automotives – could impact the chipmaker’s revenue. ADI’s guidance for Q1 was softer than anticipated, said analysts at Morgan Stanley in a note, according to The Fly.

They observed that although ADI is past the troughs after the fourth quarter (Q4), the company’s recovery is dependent on how the broader end market shapes up.

Analysts at Truist also observed that ADI’s guidance for Q1 was mixed compared to the consensus. Based on this, they lowered their price target for the stock to $216 while maintaining a ‘Hold’ rating.

Morgan Stanley has a price target of $248 with an ‘Overweight’ rating.

Of the 32 brokerages covering the stock, FinChat data shows 16 have a ‘Buy’ rating, three have an ‘Outperform’ rating, and 13 have a ‘Hold’ recommendation. The mean price target is $250.77, implying a 13.6% upside from current levels.

On a trailing twelve-months (TTM) basis, ADI’s price-to-earnings (PE) ratio stood at 67.1.

In comparison, here’s how some of its rivals fare: Texas Instruments at 35.9, Microchip Technology at 102.1, and NXP Semiconductors at 23.5, according to Koyfin data.

ADI increased its quarterly dividend by 8% to $0.99 per share and increased authorization for its share buyback program by $10 billion, taking the total authorization to $11.5 billion.

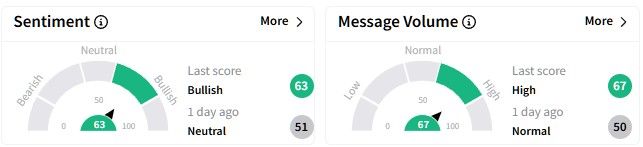

On Stocktwits, retail sentiment around the ADI stock was ‘bullish’ (63/100), rising from ‘neutral’ (51/100) a day ago.

ADI’s stock has moved sideways year-to-date (YTD), gaining a little over 4% so far. Its one-year returns stand at 16.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)