Advertisement|Remove ads.

Analog Devices Stock Gets A Flurry Of Price Target Hikes On Q1 Beat: Analysts Optimistic On Long-Term Growth Prospects, But Retail's Bearish

Shares of Analog Devices Inc. (ADI) will be in focus as markets open on Monday. The stock received a flurry of price target hikes after its first-quarter earnings beat.

Analog Devices posted earnings per share (EPS) of $1.63 in Q1, beating Wall Street estimates of $1.54. Revenue surpassed expectations, too, coming in at $2.42 billion, ahead of the estimated $2.36 billion.

However, on a year-on-year basis, Analog Devices’ EPS and revenue both edged lower, from $1.71 and $2.50 billion, respectively.

The Q1 beat sparked a flurry of price target hikes across brokerages, with analysts underscoring their bullish outlook by laying out Analog Digital's long-term growth prospects.

The beat-and-raise quarter saw Analog Devices navigate a tumultuous geopolitical environment, with Benchmark underscoring that the company delivered improvements across business segments.

Analysts at Benchmark and Wells Fargo note that ADI is set to return to its long-term growth model of 7% to 10% this year, while TD Cowen noted that the company is at the front of a cyclical recovery.

FinChat data shows the breakdown of the 29 brokerage recommendations for the ADI stock: 16 ‘Buy’ ratings, two ‘Outperform’ ratings, and 11 ‘Hold’ ratings.

The average price target for the ADI stock is $250.77, implying an upside of nearly 5% from Friday’s close.

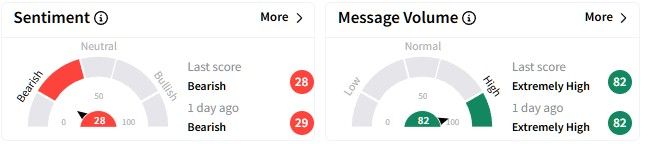

However, retail sentiment on Stocktwits around the ADI stock told a different story – it hovered in the ‘bearish’ territory, even as message volume rose to ‘extremely high’ levels.

On a trailing twelve-months (TTM) basis, ADI’s price-to-earnings (PE) ratio stood at 76.3.

In comparison, here’s how some of its rivals fare: Texas Instruments at 38.8, Microchip Technology at 107.8, and NXP Semiconductors at 25.3, according to FinChat data.

ADI’s stock has gained over 12% year-to-date (YTD), while its one-year returns stand at over 26%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)