Advertisement|Remove ads.

Apar Industries, Swaraj Engines: SEBI RA Gunjan Kumar Flags These Two Stocks For Upside Potential

Robust financials combined with bullish technical setups have put Apar Industries and Swaraj Engines on the watchlist, said SEBI-registered analyst Gunjan Kumar.

Swaraj Engines

The stock has broken out of a trend line and looks promising above ₹4,250. A sustained close above this level could signal further upside, Kumar said, while placing support at ₹4,089.

At the time of writing, Swaraj Engines’ stock was trading 0.3% higher at ₹4,102.40.

The auto parts supplier is backed by strong fundamentals like a ROCE of over 55, ROE above 40, and the highest year-on-year sales growth in the last 13 quarters.

It has virtually no debt and has seen steady buying interest from both foreign and domestic institutional investors.

The company primarily supplies diesel engines to Mahindra & Mahindra’s Swaraj Division for tractors and also produces advanced components for Swaraj Mazda vehicles.

With plans to scale up annual engine production from 1.95 lakh to 2.4 lakh units, it is investing in advanced manufacturing to meet future emission and performance standards.

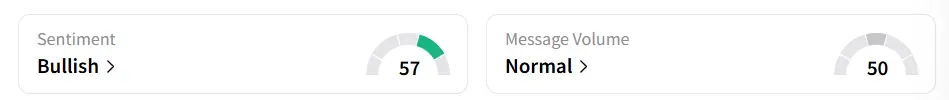

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date, the stock has gained nearly 39%.

Apar Industries

The stock has broken out of a consolidation range and looks strong above ₹8,875, the analyst noted. A sustained move above this level could lead to further upside, while support is placed at ₹8,149.

Investors booked profits on Friday after the stock closed over 7% higher in the previous trading session. Apar Industries shares were trading 2.9% lower at ₹8,498 in afternoon trade on Friday.

The analyst believes that the company appears undervalued with a strong ROCE of over 32%.

The company reported its highest revenue and profit in the last 13 quarters, and its long-term prospects are supported by ongoing government spending on infrastructure and energy projects.

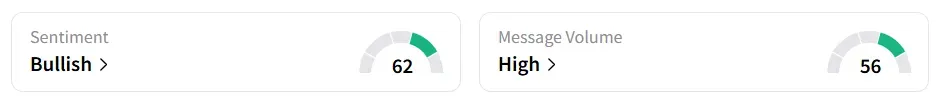

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date, the stock has shed nearly 18%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)