Advertisement|Remove ads.

Apollo Commercial In Spotlight After Keefe Bruyette Upgrades Stock, Retail Yet To Notice

Apollo Commercial Real Estate Finance (ARI) stock will likely draw retail investor chatter on Monday after Keefe Bruyette upgraded the stock to ‘Outperform’ from ‘Market Perform.’

According to TheFly, the brokerage maintained the price target at $10 despite the upgrade.

The stock has a consensus price target of $9.75 per share, according to FinChat data.

In a broader sector, the brokerage said that some commercial mortgage real estate investment trusts are positioned to gain from stronger loan originations and credit resolutions in 2025, while others remain weighed down by ongoing credit and liquidity challenges.

Rising macro uncertainty "adds a new layer of risk, potentially exposing stress in sectors that have not experienced losses”, the brokerage noted, according to The Fly.

The REIT primarily originates and invests in senior mortgages, mezzanine loans, and other commercial real estate-related debt investments. Its loan portfolio had an amortized cost of $7.1 billion as of Dec. 31.

Apollo closed $1.8 billion in new loan commitments in 2024.

However, its fourth-quarter net income fell to $37.58 million, or $0.27 per share, for the three months ended Dec. 31, compared with $43.47 million in earnings a year earlier.

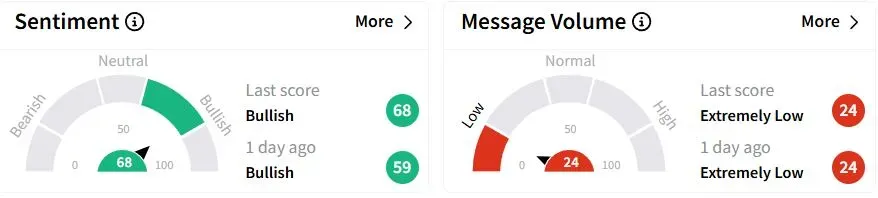

Retail sentiment on Stocktwits was in the ‘bullish’ (68/100) territory, albeit with a higher score than a day ago on Friday, while retail chatter was ‘extremely low.'

Apollo Commercial shares have fallen marginally year-to-date (YTD).

Also See: Boeing Retail Traders Hold Bullish Ground Despite Steep 20% Weekly Plunge

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)