Advertisement|Remove ads.

Boeing Retail Traders Hold Bullish Ground Despite Steep 20% Weekly Plunge

Boeing's (BA) stock fell nearly 20% over the past week on concerns over demand amid tariff-related trade tensions between the United States and China.

U.S. President Donald Trump slapped 34% additional tariffs on Chinese goods above the duties already imposed to counter, in his words, “currency manipulation and trade barriers.” China, in retaliation, also imposed reciprocal tariffs on the U.S.

The plane maker’s shares fell, tracking the broader U.S. markets, which logged the worst week since 2020.

Boeing expects demand in China to grow 5.2% annually and sees it emerge as the largest air traffic market. The company expects thousands of new aircraft orders from the country over the next 20 years.

Boeing has a completion and delivery center in Zhoushan, China, but it only builds planes in the U.S. Additional tariffs on U.S.-made products could cause Boeing to lose market share to European rival Airbus or China-based Comac.

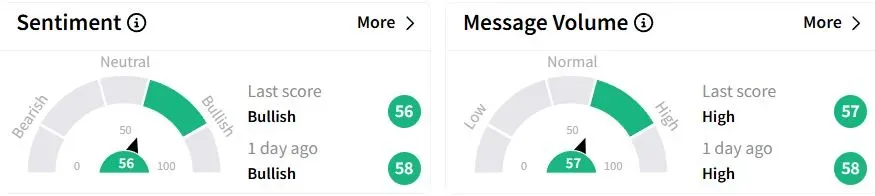

Retail sentiment on Stocktwits remained in the ‘bullish’ (56/100) territory, while retail chatter was ‘high.’

One retail trader said that Boeing does not have any problems with its order book considering its backlog, but the issue is with the supply chain and any tariff-induced costs.

Another user suggested that Boeing CEO Kelly Ortberg publicly clarify the minimal tariff impact and emphasize the company's commitment to prioritizing deliveries to the U.S. and other free trade partners.

The plane maker’s deliveries had risen by 63% compared to a year earlier.

Boeing shares have fallen 23.4% year-to-date (YTD).

Last month, the Trump Administration awarded the aerospace giant a contract to develop the next generation of fighter jets for the U.S. Air Force.

Also See: Woodside Energy In Spotlight After 40% Stake Sale In Louisiana LNG, Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)