Advertisement|Remove ads.

Apollo Global Management Weighs IPO Or Sale Of Invited In Potential Deal That Could Top $3B: Report

- Invited runs over 200 clubs nationwide after its rebrand under Apollo’s ownership.

- The operator’s portfolio includes prominent golf and city clubs with membership models built on initiation fees and monthly dues.

- The review comes as Apollo posts strong quarterly earnings and expands into large-scale energy and infrastructure projects.

Apollo Global Management is reportedly exploring whether to sell Invited or take it public, marking a move that could value the golf and membership club operator at more than $3 billion including debt

JPMorgan and Wells Fargo have been brought in to advise on the process, the report said, according to a Reuters report citing people familiar with the discussions.

Invited’s Nationwide Club Network

Invited, known as ClubCorp until Apollo bought it in 2017 for $2.2 billion, rebranded in 2022 and today runs more than 200 clubs across the U.S. Its portfolio ranges from golf and country clubs to city clubs and locations inside college football stadiums. Among its best-known properties are The Metropolitan Club in Chicago, Firestone Country Club in Akron, Ohio, and The Woodlands Country Club in Houston. Membership typically involves an initiation fee followed by monthly dues, the report said.

Apollo Advances Toward $1T AUM Goal

The review of Invited follows a strong quarter for Apollo, which reported a 20% rise in profit supported by asset growth, higher performance fees and increased debt origination. Adjusted net income reached $1.36 billion, or $2.17 per share, surpassing analyst expectations. The firm brought in $82 billion of inflows during the quarter, lifting assets under management to $908 billion and moving it closer to CEO Marc Rowan’s target of reaching $1 trillion by 2026.

Apollo’s retirement services arm, Athene, remained a central driver of results. Spread-related earnings climbed to $871 million, while fee-related earnings hit a record $652 million. The company also saw significant capital additions, including roughly $34 billion from its acquisition of Bridge Investment Group and another $10 billion entering Athene’s retail channels.

Expansion Into Offshore Wind

Apollo is also diversifying into energy and infrastructure assets. Apollo’s funds have agreed to invest $6.5 billion in Danish wind firm Orsted’s Hornsea 3, the world’s largest offshore wind project.

The North Sea project will provide 2.9 gigawatts of capacity, capable of powering more than 3 million UK homes. Apollo’s funds will take a 50% stake, with Orsted leading development and long-term operations of the project. Deal closing is expected by the end of this year.

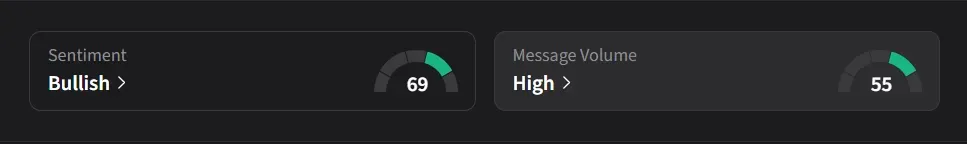

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for Apollo Management was ‘bullish’ amid ‘high’ message volume.

Apollo’s stock has declined 8% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)