Advertisement|Remove ads.

Apple Back On Retail’s Radar As Trump Briefly Spares Tech From Tariffs But Eyes New Levies

Apple, Inc. (AAPL) was among the top ten trending and most active tickers on Stocktwits late Sunday as retail investors weighed in on the implication of President Donald Trump announcing a relief, albeit temporary, for the sector.

U.S. Customs and Border Protection announced late Friday that 20 categories of products, including those falling under the “8471” code—comprising computers, tablets, computer monitors, semiconductor equipment, and other electronics products—were exempt from the reciprocal tariffs.

The announcement meant these tech products could avoid the steep 145% rate applicable for imports from China.

The optimism generated by the announcement proved short-lived. In an interview with ABC News on Sunday, Commerce Secretary Howard Lutnick said separate levies could be forthcoming.

“They’re exempt from the reciprocal tariffs but they’re included in the semiconductor tariffs, which are coming in probably a month or two,” he said.

President Trump later reinforced the view. In a post on Truth Social, the president said, “There was no Tariff “exception” announced on Friday. These products are subject to the existing 20% Fentanyl Tariffs, and they are just moving to a different Tariff “bucket.”

“We are taking a look at Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Security Tariff Investigations.”

Wedbush analyst Daniel Ives commented on the developments: “The mass confusion created by this constant news flow out of the White House is dizzying for the industry and investors and creating massive uncertainty and chaos for companies trying to plan their supply chain, inventory, and demand.”

The analyst said the spotlight will likely be on China tariff negotiations, and any progress on this game of “high stakes poker” between Beijing and DC will be crucial to the markets and the economy this week.

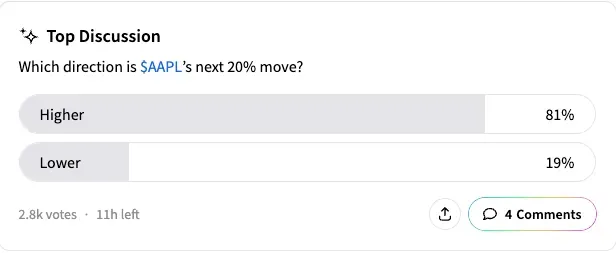

On Stocktwits, an ongoing poll asking retail investors where Apple stock is headed found that 81% of the 2,800 respondents said its next 20% move would be higher. The remaining 19% predicted a down move.

Apple stock ended Friday’s session up 4.06% at $198.15. The stock has lost over 20% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)