Advertisement|Remove ads.

Apple Stock Slumps To 2-Month Low On Negative China Tidings: Retail Warns Against Buying Dip

Apple, Inc. (AAPL) stock slumped 3.74% by Thursday’s mid-session to nearly a two-month low. The tech giant’s stock underperformed the broader market, which is trading flat.

The downside trigger was a report from market research firm Canalys, which showed that Apple ceded its top spot in the Chinese smartphone market to domestic players in 2024. The world’s most-valued company shipped 42.9 million iPhones in the country in 2024, down 17% year-over-year (YoY), and its market share eroded by four percentage points.

Vivo took the top spot, followed by Huawei, with their respective annual shipments at 49.3 million and 46 million units, respectively. Both grew shipments year over year and increased their respective market share.

Overall, the Chinese smartphone market saw a modest growth (5%) in 2024.

However, Apple led in the fourth quarter with 13.1 million devices sold, yet its shipments fell 25% year over year. Vivo and Huawei followed closely, each selling 12.9 million devices.

Amber Liu, Research Manager at Canalys, said, “Apple and its iPhone 16 series maintained the top spot in Q4 but faced growing competitive pressure from domestic flagship devices.”

She noted that Apple has attempted to drive sales through seasonal promotions, enhancement of high-end competitiveness, user retention initiatives, trade-in programs, and expanded coverage of interest-free installment plans.

The data point does not bode well for Apple, as China is a key market for the company in terms of sales and the supply chain. The Greater China region, which comprises mainland China, Hong Kong, Taiwan, and Macau, accounted for about 16% of Apple’s worldwide sales in the September quarter.

Canalys’ numbers pertain only to mainland China.

The firm's findings add to mounting evidence pointing to another year of lackluster sales for its flagship product. Last week, Taiwan-based analyst Ming-Chi Kuo said China weakness is one of the challenging hurdles for Apple in 2025.

Apple is scheduled to report its fiscal 2025 first-quarter results after the market closes on Jan. 30. Analysts, on average, expect Apple to report earnings per share (EPS) of $2.35, up from $2.18 a year earlier.

The consensus estimate called for a modest 4% revenue growth to $124.77 billion.

Apple is currently the top trending ticker on Stocktwits.

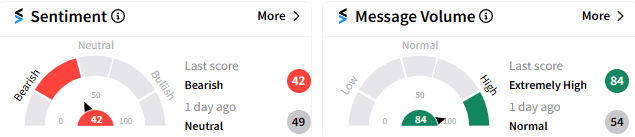

Retail sentiment toward Apple stock turned to ‘bearish’ (42/100) from ‘neutral’ a day ago, although message volume spiked to ‘extremely high.’

A retail watcher of the stock pointed to the “bloated” valuation despite the company's YoY sales declines.

Another suggested a freefall once the stock breaks below $220. The same sentiment was echoed by a fellow retailer.

Apple stock has lost about 5% since the start of 2025, as it trades off the all-time high of $260.10 as was seen on Dec. 26

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)