Advertisement|Remove ads.

Apple Stock Slips Ahead Of Q4 Results As Analyst Loses Sleep Over Guidance: Retail Mood Stays Sour

Tech giant Apple, Inc. ($AAPL) is all set to report its fourth-quarter and fiscal year 2024 results after the market closes on Thursday, and investors will likely be glued to the report, especially after its mega-cap peers Meta Platforms, Inc. ($META) and Microsoft Corp. ($MSFT) failed to impress with their quarterly results.

Q4 Expectations

Apple is widely expected to report year-over-year growth for its second-best seasonally strong quarter, which encompasses the back-to-school season.

Analysts, on average, expect the company to report earnings per share (EPS) of $1.60 and revenue of $94.52 billion. This compares to last year’s figures of $1.36 and $83.6 billion, respectively.

On the previous earnings call, CFO Luca Maestri, who will be hosting his final earnings call before transitioning from the role on Jan. 1, 2025, said the Sept. quarter revenue growth will likely be similar to the 4.9% growth reported for the June quarter.

Morgan Stanley’s Erik Woodring models strong September quarter beat, thanks to late-cycle iPhone 15 strength. The firm expects the results to surpass the consensus by 2-4%, premised on higher iPhone shipments and average selling price (ASP), partly offset by weaker Mac revenue.

The analyst estimates iPhone revenue of $49.03 billion (55 million units @ $891 ASP) versus the consensus of $45.06 billion. He models iPad revenue of $6.40 billion, below the $7.12-billion consensus.

The firm’s Mac revenue estimate of $6.57 billion also trailed the consensus estimate of $7.83 billion.

For the wearables, home and accessories segment, it estimates revenue of $8.98 billion compared to the consensus of $9.16 billion.

Woodring looks forward to Services revenue of $25.30 billion, roughly in line with Wall Street’s average forecast of $25.25 billion. This high-margin business is expected to turn in a record performance yet again.

The analyst estimates YoY App Store net revenue growth of 13.4%.

The focus will be on revenue from Mainland China - a key market for Apple. The region was the lone geography which saw YoY revenue decline in the June quarter.

Apple investors may also seek some color on the uptake of the company’s iPhone 16, which is armed with Apple Intelligence. The newest iteration went on sale on Sept. 20.

Forward Outlook

For the key holiday quarter, analysts forecast EPS of $2.38 and revenue of $127.53 billion, translating to top line growth of 14.20%.

Morgan Stanley’s Woodring estimates December quarter revenue and earnings per share to be 1-2% below the consensus estimate, reflecting a more conservative iPhone shipment assumption. He said data points point to potential iPhone build cuts in the near term.

For the December quarter, the analyst estimates revenue of $125 billion and EPS of $2.36 billion.

Stock Performance

Apple shares are flattish in the premarket trading. As of 9:55 am EDT, it edged down 0.48% to $229:08. The stock has gained about 20% year-to-date.

The company is now the most valued global corporation, with Nvidia Corp. ($NVDA) breathing down its neck.

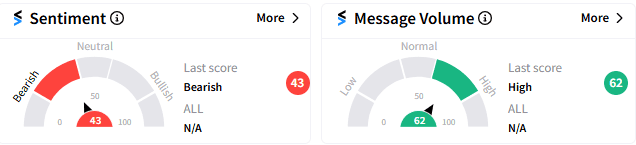

Retail sentiment on Stocktwits remained "bearish" (43/100), albeit with "high" message volume.

On Stocktwits, a user posted a technical chart showing Apple stock staying around its 20-day moving average of $230. A failure to bounce above could take the stock down to $225, he said.

Another user sees the Services business outperforming and contributing to overall strength.

Read Next: TMTG, CoreCivic, Humana Stocks Poised For Gains With Trump Victory: Retail Sentiment Mixed

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)