Advertisement|Remove ads.

TMTG, CoreCivic, Humana Stocks Poised For Gains With Trump Victory: Retail Sentiment Mixed

Although a compilation of nationwide polls gives Vice President Kamala Harris a narrow lead over her rival and Republican nominee Donald Trump, a few key polls have put the latter ahead.

Against this backdrop, Trump-linked stocks and Trump trades - a term referring to stocks of companies potentially benefiting from the former president’s proposed policy measures, have come into the spotlight.

Billionaire investor Stanley Druckenmiller said in an interview with Bloomberg earlier this month that “the market and the inside of the market is very convinced Trump is going to win.”

“You can see it in the bank stocks, you can see it in crypto, you can see it in DJT, his social media company,” he added.

Druckenmiller, who runs the Duquesne Family Office, may have a point there. Shares of Trump’s media company which owns the Truth Social platform have been on tear in recent sessions.

Trump Media & Technology Group Corp. ($DJT)

TMTG, which bottomed at $11.75 in late-September after the post-IPO lock-up expiration, have come back up stronger since then. Between September 23 and Monday’s session, the stock has added a whopping 290%.

As of 11:22 am ET on Tuesday, the stock gained 10.87% to $52.51.

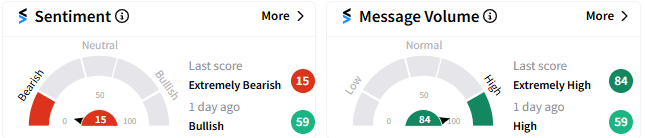

Trader sentiment, however, flipped from ‘bullish’ (59/100) a day ago to ‘ extremely bearish’ (15/100). Chatter among traders has increased to ‘extremely high.’

CoreCivic, Inc. ($CXW)

Prison stock CoreCivic could be one of the biggest beneficiaries of a potential Trump win, given his pledge to crackdown on undocumented immigrants.

The private operator of prison had rallied ahead of the 2016 election held on November 8 and the uptrend continued a little after Trump assumed office.

CoreCivic has been trading flattish for the year-to-date period. As of 11:22 am ET, the stock rose 0.62% to $14.54.

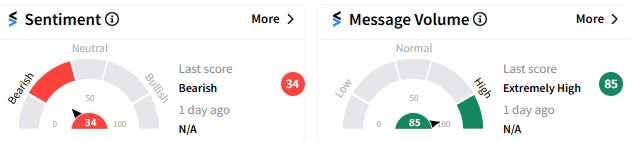

On Stocktwits, sentiment toward CoreCivic was ‘bearish’ (34/100) but message volume was ‘extremely high.’

Humana, Inc. ($HUM)

Healthcare stocks have come under pressure during President Joe Biden’s administration due to the regulatory bottlenecks that have forced these companies to provide services at subsidized costs.

Humana, which offers medical and specialty insurance products, has seen its stock plummet over 42% for the year-to-date period.

“If Trump wins, you probably want to own Medicare Advantage,” says Chris Meekins, a healthcare policy analyst at Raymond James, according to Barron's.

“The assumption is that after two years of very challenging regulatory actions by the Biden administration, and what people believe the Harris administration would continue, that a Trump administration would bring relief,” he added.

As of 11:22 am ET, Humana fell 0.54% to $259.68.

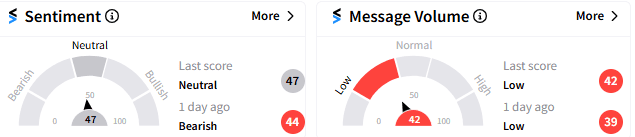

Sentiment of retailers have continued to be ‘neutral’ (47/100) toward Humana, with message volume ‘low.’

Read Next: Bitcoin Breaks $71K Barrier, Hits 5-Month High as Retail Bulls Charge Ahead

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)