Advertisement|Remove ads.

Arm Holdings Draws Investor Interest As Stock Continues To Hover Near 200-DMA After 4 Consecutive Sessions Of Decline

- ARM stock up 0.5% in premarket trade on Monday after four successive sessions of declines.

- Arm’s shares have witnessed significant resistance near the $183 mark this year – a level they have nudged but failed to surpass twice this year.

- Arm reported revenue of $1.14 billion in Q2, beating the estimated $1.06 billion, according to Stocktwits data.

After four consecutive sessions of declines, Arm Holdings (ARM) stock is trading near its 200-day moving average (200-DMA) for the first time in two months. The stock traded 0.5% higher in Monday’s pre-market.

In the recent pullback, the stock shed nearly 10% and is currently trading near the $140 mark. Notably, Arm’s shares have witnessed significant resistance near the $183 mark this year – a level they have nudged but failed to surpass twice this year. With the stock hovering near its 200-DMA, investors will be eyeing the upcoming sessions for developing trends.

Q2 Results

The chipmaker has been on a downtrend lately, despite posting a better-than-expected second-quarter (Q2) print.

Arm reported revenue of $1.14 billion in Q2, beating the estimated $1.06 billion, according to Stocktwits data. Its royalty revenue climbed 21% to $620 million, driven by higher royalty rates per chip, while its license and other revenue surged 56% to $515 million.

On a non-GAAP basis, the company expects third-quarter revenue of about $1.225 billion (+/- $50 million). Operating expenses are estimated at around $720 million, and an earnings per share (EPS) of $0.41 (+/- $0.04).

How Did Stocktwits Users React?

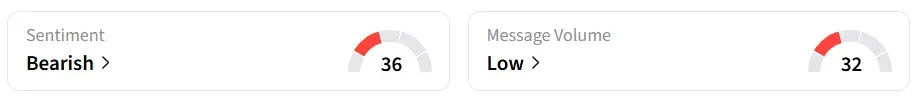

Retail sentiment on Stocktwits remained in the ‘bearish’ territory for the past 24 hours. The stock has a short interest of 1.4%, according to Koyfin data.

Tech stocks, in general, have been on a decline despite positive quarterly results and an optimistic outlook. Investors have been sceptical about valuation and the sustainability of growth driven by artificial intelligence.

Arm’s stock has gained over 11% year-to-date.

Read also: Bitcoin Price Struggles While Crypto Liquidations Top $500 Million – Analyst Flags Retail Pressure

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)