Advertisement|Remove ads.

Arm Holdings’ Strong Q3 Draws Slew Of Price Target Hikes, Analysts Call It ‘Biggest Beneficiary’ Of AI Surge

Arm Holdings Plc.’s (ARM) strong third-quarter performance drew a slew of price target hikes from analysts, who underscore that the chip designer could very well be the “biggest beneficiary” of the surge in artificial intelligence (AI) penetration.

Arm Holdings reported earnings per share (EPS) of $0.39 during the third quarter, beating an estimate of $0.34, according to Stocktwits data.

The British semiconductor designer posted a revenue of $983 million during the quarter, topping Wall Street’s expectation of $949 million.

Arm Holdings CEO Rene Haas expressed optimism about the company’s solutions for addressing needs from the cloud to the edge.

He highlighted the chip designer’s partnership with OpenAI on the $500 billion Stargate project and a new enterprise AI offering called “Cristal intelligence,” which aims to boost productivity.

“We strongly believe that the advances in AI, both for training and inference, are going to increase the demand for compute in the AI cloud,” Haas said.

Arm Holdings’ third-quarter (Q3) performance has analysts excited. According to TheFly, Jefferies, JPMorgan, Citi, and other brokerages hiked their price targets for the stock, ranging between $174 and $225.

Evercore ISI analyst Mark Lipacis thinks Arm Holdings could likely be the “biggest beneficiary of AI penetration at the edge,” and that this could be closer than initially anticipated due to the launch of DeepSeek.

Citi analysts think momentum is “clearly building” across Arm’s various business segments.

While underscoring their bullish outlook on the Arm stock, Wells Fargo analysts tempered expectations, stating that the stock could take a breather in the near term.

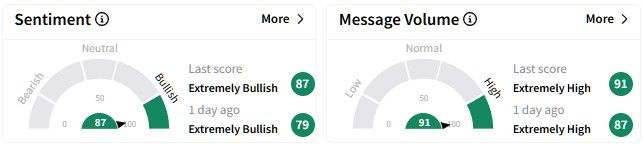

Retail sentiment on Stocktwits around the Arm Holdings stock remained in the ‘extremely bullish’ (86/100) territory, while message volume also increased to ‘extremely high’ levels.

Meanwhile, one user said they “love the look” of the Arm Holdings stock.

Arm Holdings’ share price has gained nearly 53% over the past six months, while its one-year return stands at an impressive 137%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)