Advertisement|Remove ads.

Asana Stock Tumbles As Subpar Revenue Guidance, CEO Retirement Overshadow Upbeat Q4 – Retail Sentiment Plummets

Asana, Inc. (ASAN) shares tumbled in Tuesday’s premarket session as investors digested the enterprise work management platform provider’s subpar revenue guidance and a leadership transition. However, the company’s quarterly results exceeded the consensus estimates.

The San Francisco, California-based company announced that Dustin Moskovitz has informed the board of his intention to step down as CEO once a replacement is found and transition to the role of Chairman.

Separately, Asana reported break-even results on an adjusted basis for the fourth quarter of the fiscal year 2025 compared to an adjusted loss per share of $0.04 a year ago. The bottom-line result beat the consensus estimate for a loss of $0.01 per share.

Revenue climbed 10% year over year (YoY) to $188.3 million, roughly in line with the average analysts’ estimate of $188.13 million.

While the bottom-line result exceeded the guidance, quarterly revenue was just shy of the $188.50 million estimated by the company.

CFO Sonalee Parekh said, “FY25 was a pivotal year for Asana, with stabilization across key metrics, our emergence as a multi-product company, achieving over 800 basis point improvement in Q4 non-GAAP operating margin and positive free cash flow for the full year—a major milestone on our path to sustained profitable growth.”

Moskovitz noted that the early momentum with AI Studio exceeded expectations, with “strong early customer adoption across segments and geographies, rapidly growing credit usage and a multi-million dollar pipeline.

Among operational metrics, the annualized growth in the number of core customers (defined as ones spending $5,000 or more) was 11% YoY at 24,062, the same pace of growth as in the third quarter.

The number of customers spending $100,000 or more on an annualized basis was 726, up 20%, faster than the 18% growth in the third quarter.

The dollar-based net retention rate was 96%, the same as in the previous quarter.

Parekh said the company’s efficiencies and productivity gains position it to achieve a 1,000-point improvement in non-GAAP operating margin in the fiscal year 2026. The company is also set to achieve non-GAAP profitability, beginning in the first quarter of the new fiscal year.

Asana expects first-quarter adjusted earnings per share (EPS) of $0.02 and revenue of $184.5 million to $186.5 million. Analysts, on average, estimate a loss of $0.01 and revenue of $190.69 million.

It forecasts a 1%-2% non-GAAP operating margin.

For the fiscal year 2026, the company projected a non-GAAP EPS of $0.19-$0.20 versus the $0.01 per share loss estimated by analysts. It guided revenue to $782 million to $790 million, below the consensus estimate of $802.98 million.

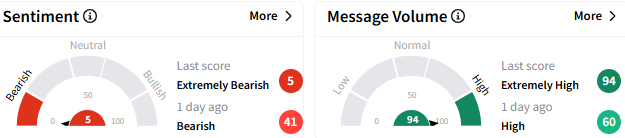

On Stocktwits, sentiment toward Asana stock worsened to ‘extremely bearish’ (5/100) from the ‘bearish’ mood that prevailed a day ago. Reflecting heightened trader chatter, the message volume spiked to ‘extremely high’ levels.

A bearish watcher panned Asana for its inadequate cash reserves, liquidity issues, and loss-marking streak.

Another user lamented the slowdown in revenue growth from 13.88% last year to just 10%.

In premarket trading, Asana stock plunged 27.46% to $12.10, heading toward the lowest level since Nov. 5. If the premarket losses are sustained, the stock is on track to record its biggest one-day loss ever. The stock has lost about 18% year-to-date

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)