Advertisement|Remove ads.

SIDU Stock Is Already Up 390% In The Last Month – Why Is Retail Still Bullish?

- Sidus Space has been named as one of the awardees for the Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) contract, part of the larger Golden Dome mission, with a $151 billion contract ceiling.

- The company has also been expanding beyond space satellites to end-to-end space manufacturing, AI-driven data solutions, and space and defense hardware.

- Shares of SIDU were up over 19% on Friday morning.

Shares of Sidus Space Inc. (SIDU) have gained over 390% in the past month, making the space stock one of the most noticeable movers in the market. Despite the massive rally, retail investors remain bullish on the stock.

Some investors expect the shares to cross the $4 mark in Friday’s trade, while others are gunning for SIDU shares to surge to as high as $10 in the long term. The stock is already up over 19% in Friday’s premarket trade, hovering around the $3.72 mark at the time of writing.

Retail traders are optimistic that Sidus Space will benefit from the overall rally in space stocks in 2025, partly due to chatter about SpaceX’s public offering, and further buoyed by the Trump administration’s expansive space policy. In addition, the company won a large contract from the Missile Defense Agency (MDA) and announced the pricing of a public offering of 19 million shares.

What Are Stocktwits Users Saying?

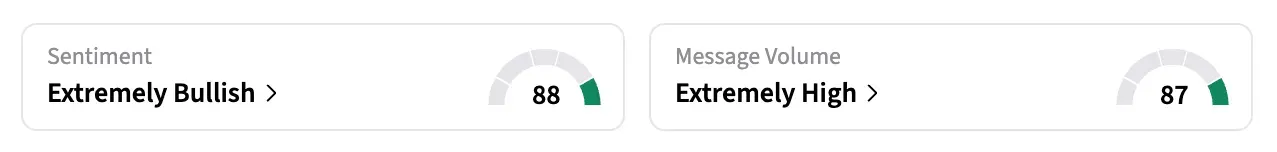

On Stocktwits, retail sentiment around Sidus Space stock has remained in the ‘extremely bullish’ territory over the past month amid ‘extremely high’ message volumes.

One user noted the Sidus Space’s shift from commercial to government contracts, while also highlighting the upcoming SpaceX initial public offering and AI data center boom as positives for the company.

Another user noted that the stock could still be in price-discovery mode.

One bullish user noted that while the stock may not be risk-free, its momentum was worth noting.

Long-Term Value

Earlier in December, Sidus Space announced its selection as one of the awardees for the Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) contract with a $151 billion ceiling. This deal, part of the broader Golden Dome missile defense strategy in the U.S., makes Sidus eligible to compete for future task orders. Shortly after, the space company announced a public offering that raised approximately $25 million.

In the past year, Sidus has also been expanding its footprint beyond space satellites, building up for end-to-end space manufacturing, AI-driven data solutions, and space and defense hardware.

The company has also enjoyed a leg up amid the broader move in the space sector, amid SpaceX’s massive IPO chatter and the White House’s push for more lunar exploration, commercial launch services, and sustainable, cost-effective space missions.

Shares of SIDU have gained nearly 3% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)