Advertisement|Remove ads.

Why Did Ironwood Pharmaceuticals Stock Skyrocket Today?

- The outlook assumes net sales for Linzess will be between $1.125 billion and $1.175 billion in FY2026.

- U.S. FDA had approved Ironwood’s Linzess capsules for pediatric patients, in November.

- Linzess is the first treatment approved for the irritable bowel syndrome with constipation in pediatric patients.

Shares of Ironwood Pharmaceuticals (IRWD) jumped more than 38% in premarket trading on Friday after its FY2026 guidance came in above expectations, boosted by higher sales of its drug Linzess, which is used to treat constipation.

The biotechnology company said it expects FY2026 revenue in the range of $450 million to $475 million, higher than analyst expectations of $319.5 million, according to data from Fiscal.ai.

The outlook assumes net sales of Linzess will be between $1.125 billion and $1.175 billion in FY2026, driven by improved net price and low-single-digit demand growth, the company said.

“We believe our full-year 2026 guidance demonstrates the significant progress we’ve made to deliver on these priorities to help drive value for shareholders moving forward,” it stated.

Linzess’ Potential

In November, the U.S. Food and Drug Administration approved Ironwood’s Linzess capsules for pediatric patients aged seven and older with irritable bowel syndrome with constipation.

Linzess is the first treatment approved for the disease in pediatric patients, the FDA had said at the time. Irritable bowel syndrome with constipation (IBS-C) is a common functional gastrointestinal disorder characterized by recurrent abdominal pain associated with infrequent, hard-to-pass stools. The contributing factors to the condition are typically multiple.

Linzess is already approved for the treatment of adult patients with the condition. The FDA had noted that the safety and efficacy of Linzess were similar in clinical studies for both adults and pediatric patients.

“Throughout 2025, we made significant progress in maximizing LINZESS while delivering sustained profits and cash flows in an effort to strengthen our financial position and maintain compliance with debt covenants over the coming quarters,” said Tom McCourt, chief executive officer of Ironwood. “We expect higher net sales in 2026 for LINZESS year-over-year,” he added.

How Did Stocktwits Users React?

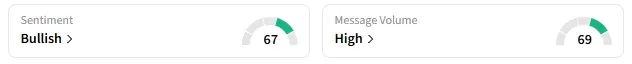

Retail sentiment around IRWD trended in ‘bullish’ territory amid ‘high’ message volumes.

One user wondered whether the stock will hit the $10 mark.

Shares in the IRWD fell 25.1% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)