Advertisement|Remove ads.

Ashok Leyland In Strong Uptrend: SEBI RA Advises Buy-on-Dips Strategy

Ashok Leyland is currently displaying a strong uptrend on the daily chart, according to SEBI-registered analyst Deepak Pal.

Ashok Leyland’s stock has been consistently trading above its 14-day, 55-day, and 200-day exponential moving averages (EMAs), which indicate underlying strength across multiple timeframes. The shares have also managed to sustain trading above the ₹250 level following a rally, Pal observed.

Technical indicators further support the bullish momentum. The Parabolic SAR dots are positioned below the price, indicating continued upward momentum. At the same time, the moving average convergence/divergence (MACD) shows positive divergence, with the MACD line trading above the signal line.

The Relative Strength Index (RSI) is around 66, indicating an uptrend without being overbought. This is an indicator of further potential gains.

Given the favorable setup, he picked Ashok Leyland as a candidate for a ‘buy on dips’ strategy and recommended a stop loss at ₹240. If the current trend persists, the stock has the potential to test the ₹260 - ₹265 range in the near term.

From a fundamental perspective, Ashok Leyland has a return on equity (RoE) of 30 - 31% and return on capital employed (RoCE) around 16%. Its expansion into electric and hybrid vehicles, along with increasing exports, makes it a good long-term investment candidate. However, investors should be mindful of the company’s high debt level and valuation, the analyst added.

On Wednesday, the company fixed July 16 as the record date for the issue of bonus shares. It had previously announced the issue of free shares in a 1:1 ratio.

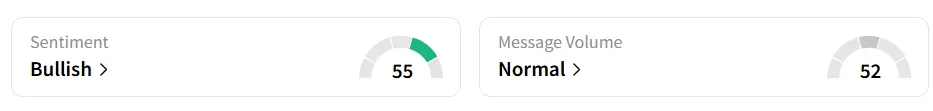

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week ago. It was also among the top 10 trending stocks on the platform.

The stock has gained 13.6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)