Advertisement|Remove ads.

ASML’s China Push Excites Retail Traders Even As US Sanctions Fears Weigh On Stock

Shares of ASML Holding NV (ASML) plunged 6.7% during Monday’s regular trade and extended the decline in after-market hours even as the company announced expansion into the Chinese market.

Amid rising tensions between the U.S. and China, ASML’s expansion in the country to set up a production facility was cheered on by retail investors on the Stocktwits platform.

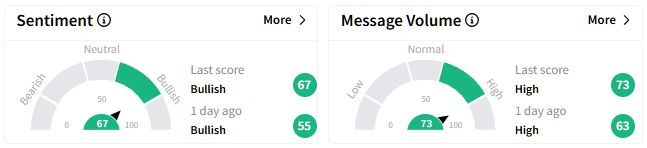

Chatter among users on the platform surged by 4,800% in the last 24 hours, while the broader sentiment soared in the ‘bullish’ (67/100) territory.

ASML disclosed in its latest annual report that the Netherlands-headquartered chipmaking tool manufacturer will set up a reuse and repair center in 2025 in Beijing.

This comes months after the U.S. extended sanctions on chip manufacturing technology suppliers to include metrology, which is used to measure and validate semiconductor materials.

Moreover, China’s homegrown tech giant Huawei has reportedly developed a technology to directly take on ASML, which holds a global monopoly in producing extreme ultraviolet (EUV) photolithography equipment.

Huawei’s technology, dubbed laser-induced discharge plasma (LDP) could decouple Chinese chipmakers from ASML and allow them to manufacture advanced chips, working around U.S. sanctions.

Huawei has also caught the U.S. off-guard with its recent smartphone powered by a 7-nanometer chip, despite sanctions making it difficult for Chinese companies to access advanced chips.

Users were generally optimistic on Stocktwits despite the ASML stock falling on Monday.

However, some users expressed a bearish outlook amid a wider decline across the market.

Koyfin data shows the average price target for the ASML stock is $881.29, implying an upside of 29% from Monday’s closing price. Of the 39 brokerage calls, 29 have a ‘Buy’ or a ‘Strong Buy’ recommendation, nine suggest holding the stock, while there’s one ‘Sell’ rating.

ASML’s stock has witnessed a volatile 2025 so far, with its stock declining 1.44%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)