Advertisement|Remove ads.

ASP Isotopes Rises On Deal With Bill Gates-Backed TerraPower — Retail Says Company Can Finally Move Beyond Short-Seller Report

ASP Isotopes (ASPI) stock jumped in extended trading on Monday after the company signed an agreement to supply enriched uranium to Bill Gates-backed nuclear energy firm TerraPower.

Under the agreement terms, Terrpower would provide ASP with a multiple-advance term loan to partially finance a proposed new uranium enrichment facility at Pelindaba, South Africa.

The facility would be capable of producing high-assay low-enriched uranium (HALEU) with an annual output of approximately 15 metric tons.

The company also agreed to supply HALEU for the first fuel core for TerraPower’s Natrium Plant in Wyoming. ASP expects to provide 150 metric tons of HALEU from 2028 through the end of 2037.

The South Africa facility is expected to begin operations in 2027 upon receipt of all required permits and licenses.

Monday’s agreement finalized a term sheet agreement between the two companies, which was struck last year.

“Nuclear fuel has one of the most severely compromised supply chains of any material in the world. The world is in urgent need of additional suppliers,” ASP CEO Paul Mann said.

HALEU is enriched between 5% and 20% and is the key to many advanced, smaller reactors with more power per unit of volume.

There is a broad bipartisan support for nuclear power, which the U.S. lawmakers believe could be the answer to the rapid rise in power demand. However, currently, Russia is the only viable HALEU supplier of scale.

The companies said they would explore opportunities to produce HALEU within the U.S.

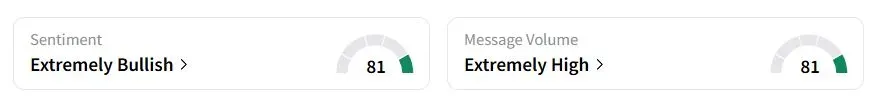

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (81/100) territory, while retail chatter was ‘extremely high.’

“This feels like where we were before Fuzzy Panda. This time, though, even though its prospects and potential are the same as then, the company is in a stronger position,” one retail trader said.

The stock declined in November after short seller Fuzzy Panda accused the company of misleading investors. ASP had denied the allegations.

ASP Isotopes stock has gained 60% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)