Advertisement|Remove ads.

Citi Downgrades Patterson-UTI, Helmerich & Payne On Oil Price Risk — Retail Surprised By ‘Brutal’ Selloff

Patterson-UTI Energy (PTEN) and Helmerich & Payne (HP) stocks fell on Monday after Citi downgraded the oilfield services firms to ‘Neutral’ from ‘Buy’ due to risks to crude prices.

According to TheFly, Citi lowered Patterson-UTI's price target to $6.5 from $8 and cut H&P’s target to $19 from $25.

The brokerage noted that public exploration and production companies' responses to the pullback in crude prices have been more pronounced than originally expected.

Citi also believes that there is a greater desire by oil and gas explorers and producers to push for rate concessions for higher-spec drilling and fracking equipment.

While stocks are down, the brokerage noted that reductions in rates of 5% % to 10% "greatly compress" free cash flow.

Crude oil prices have come under pressure due to a rise in production by the OPEC+ countries. While a pause on reciprocal tariffs on China has alleviated some demand concerns, Moody’s downgrade of the U.S. sovereign credit rating has pushed back oil prices amid talks between the U.S. and Iran.

Oil producers have reduced activity due to the decline in production. Baker Hughes data showed that the U.S. rig count fell to its lowest level since January after the first week of May.

Top oilfield firms have already projected declines in drilling activity in North America for the entire year.

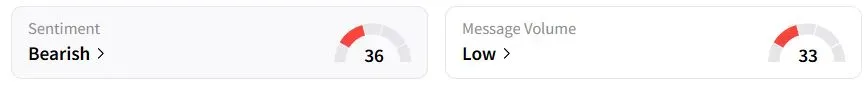

Retail sentiment on Stocktwits about Patterson-UTI was in the ‘bearish’ (36/100) territory, while retail chatter was ‘low.’

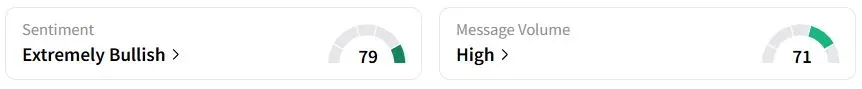

Meanwhile, sentiment on H&P was still ‘extremely bullish’ (79/100), and retail chatter was ‘high.’

“Brutal, I thought $25 was cheap,” one retail trader said about H&P.

This year, Patterson-UTI and Helmerich & Payne stocks have fallen 29.7% and 48.7%, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)