Advertisement|Remove ads.

Aspen Aerogels Stock Sinks To One-Year Low As Weak Q1 Outlook Overshadows Q4 Beat: Retail Sentiment Peaks

Aspen Aerogels Inc. (ASPN) plunged as much as 25% on Thursday morning, reaching its lowest level since November 2023, after issuing disappointing first-quarter (Q1) guidance that outweighed its stronger-than-expected fourth-quarter (Q4) results.

The sustainability and electrification solutions provider posted earnings per share (EPS) of $0.14, beating analyst expectations of $0.08, according to Koyfin.

Revenue for the quarter surged 46% year-over-year (YoY) to $123.1 million, surpassing Wall Street’s estimate of $114.42 million.

For the full year, Aspen reported $452.7 million in revenue, marking a 90% YoY increase. Net income came in at $13.4 million, though that figure included a $27.5 million one-time charge related to the redemption of its convertible note.

CEO Don Young highlighted the company’s expansion, stating, "Our financial results for 2024 underscore the scalability of our business model and leading market position. In addition to exceeding our initial revenue and profitability expectations, we added multiple OEMs to our growing list of customers."

However, Aspen's guidance for Q1 2025 disappointed investors. The company expects revenue between $75 million and $95 million, significantly below analysts' forecast of $104.2 million.

It also projects a net loss per share ranging from $0.18 to breakeven, compared to the expected EPS of $0.08.

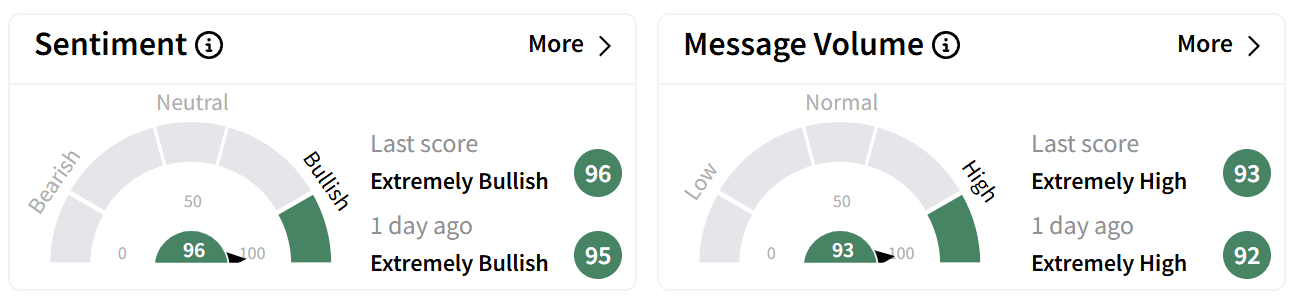

Despite the stock’s massive decline, retail sentiment on Stocktwits was ‘extremely bullish’ accompanied by ‘extremely high’ chatter – marking a year-high for Aspen Aerogels’ shares on both fronts.

Platform data shows that message volumes jumped by over 940% in the last 24 hours, the highest jump within materials stocks trailing only Trinseo PLC, which also reported its fourth quarter results after market close on Wednesday.

Adding to market uncertainty, Aspen announced it has halted construction of its planned second manufacturing facility in Statesboro, Georgia.

Instead, the company will focus on expanding its existing East Providence plant and utilizing third-party manufacturing to meet demand.

Chief Financial Officer Ricardo Rodriguez pointed to increased external manufacturing capacity as the key reason for scrapping the project.

Users on Stocktwits celebrated the company’s earnings but warned that its trajectory remains closely tied to General Motors’ electric vehicle (EV) sales. Aspen maintains a strategic partnership with GM, supplying thermal barriers for EV batteries.

Aspen Aerogels' stock is now down 27% year-to-date and 31% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trinseo Stock Swings As Retail Chatter Spikes On Q4 Results, Restructuring Efforts

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)