Advertisement|Remove ads.

AST SpaceMobile Lands $100M Financing Deal, But Retail Stays Skeptical

AST SpaceMobile, Inc. (ASTS) announced on Thursday that it has secured a $100 million equipment financing deal, spearheaded by Trinity Capital Inc. (TRIN), to support its plans for satellite manufacturing and network expansion over the next two years.

AST SpaceMobile’s stock was up more than 1% in morning trade after the announcement.

The non-dilutive credit facility, which drew $25 million immediately against already acquired gear, extends through 2031 and leverages current and future equipment as collateral.

Non-dilutive funding is financial support a company obtains without issuing new shares or reducing the ownership percentages of current shareholders.

AST SpaceMobile has been strengthening its balance sheet through a series of funding steps this year. These include a convertible note issuance in January 2025, the repurchase of half of those notes following a stock surge of over 100% in six months, and the utilization of an at-the-market equity offering.

The company ended the second-quarter (Q2) with more than $900 million in cash and equivalents.

Last week, the company announced plans to repurchase $225 million of its 4.25% convertible notes maturing in 2032. The buyback will occur through privately arranged agreements with certain noteholders and a registered direct equity offering.

In early June, AST SpaceMobile reached a significant deal enhancing its spectrum access in both the U.S. and Canada.

Under the settlement term sheet with Ligado Networks LLC, Viasat Inc. (VSAT), and Inmarsat Global, the company secured rights to utilize up to 45 MHz of valuable lower mid-band spectrum.

The satellite-to-smartphone communications company’s stock has more than doubled year-to-date and has quadrupled in the past 12 months.

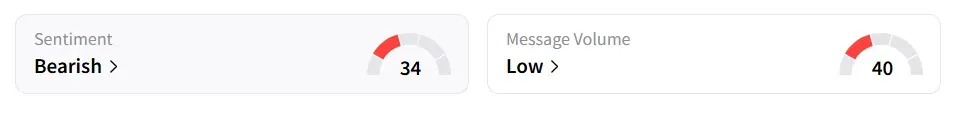

On Stocktwits, retail sentiment toward AST SpaceMobile remained in ‘bearish’ territory amid ‘low’ levels of message volume.

Also See: Apple’s China iPhone Sales Rebound In Q2, Ending 2-Year Slump

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)