Advertisement|Remove ads.

AstraZeneca Q2 Beats On Cancer Drug Sales, Maintains Guidance — Shares Rise Premarket As Retail Cheers

AstraZeneca stock climbed nearly 3% in Tuesday’s early premarket session after the Cambridge, U.K.-based biopharma giant reported a beat for the second quarter of the fiscal year 2025 and reiterated its full-year outlook.

The company reported second-quarter core earnings per share (EPS) of $1.58, a 27% increase year over year (YoY), and revenue of $14.46 billion, representing a 12% rise.

The results exceeded the company's compiled consensus estimates of $2.16 billion and $14.46 billion, respectively, Reuters reported.

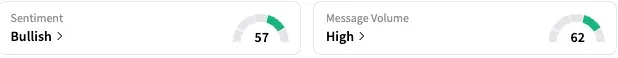

On Stocktwits, retail sentiment toward AstraZeneca stock stayed ‘bullish’ (57/100) early Tuesday, and the 24-hour message volume was also at ‘high levels.

A bullish watcher lauded the company for an “excellent earnings report.”

Product sales rose 11% to $13.80 billion, or 95.4% of the total revenue, thanks to double-digit growth in Oncology and biopharmaceutical sales.

Its oncology franchise fetched revenue of $6.32 billion, accounting for 44% of the total revenue and witnessing 18% growth. Imfinzi and Tagrisso sales jumped 10% and 13%, respectively.

Respiratory and Immunology Revenue climbed 13% to $2.15 billion, or 15% of the total.

The company said all the major geographical regions saw YoY revenue growth. The U.S., which accounted for 43% of the company's total revenue, experienced 13% growth.

AstraZeneca CEO Pascal Soriot said, “Our strong momentum in revenue growth continued through the first half of the year … with 12 positive key Phase III trial readouts including for baxdrostat, gefurulimab, and Tagrisso in just the past few weeks.”

Looking ahead, AstraZeneca reiterated its revenue and core EPS growth guidance for the fiscal year 2025, expecting high-single-digit constant currency revenue growth and low double-digit core EPS growth.

Soriot noted that the company has pledged $50 billion to expand in the U.S., its key market, amid President Donald Trump’s push to bring manufacturing back onshore. The company is making its biggest-ever investment in a manufacturing facility in Virginia.

He reiterated the company’s long-term goal of hitting $80 billion in revenue by 2030.

AstraZeneca’s U.S.-listed shares have gained about 4.6% this year, underperforming the broader market.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Stellantis Stock Slides Premarket As Auto Giant’s Reinstated Guidance Leaves Investors Unimpressed

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wendy_s_resized_jpg_9b298d0aee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)