Advertisement|Remove ads.

AST SpaceMobile Stock Plunges After Warrants Redemption Notice: What Is Retail Thinking?

Shares of AST SpaceMobile Inc (ASTS) plunged nearly 9% on Wednesday morning after the company said it will redeem all of its publicly traded warrants that remain outstanding at 5:00 pm New York City time on Sept. 27 to purchase shares of Class A common stock.

AST SpaceMobile said the stock price condition was satisfied on Aug. 23, the third trading day prior to the notice of redemption being sent to warrant holders.

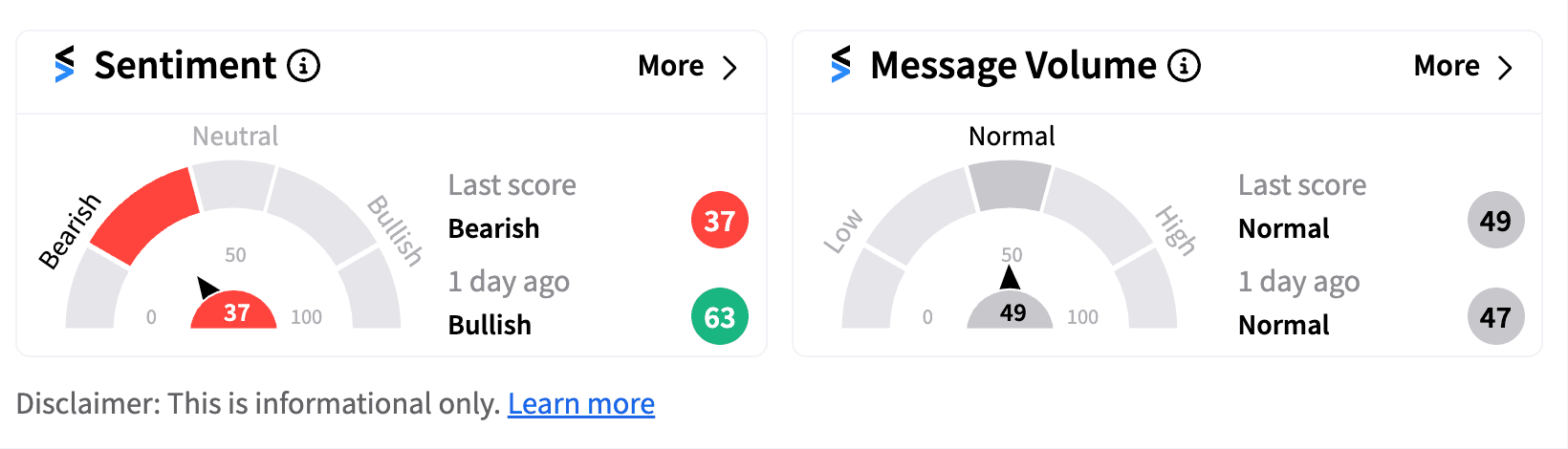

In the wake of the disclosure, retail sentiment on Stocktwits dipped into the ‘bearish’ territory (37/100) from ‘bullish’ a day ago as investors began considering the impact of the dilution post the exercise of the warrants.

Stocktwits users are disappointed with the development and the expected dilution of the stock.

Earlier this month, AST SpaceMobile received several analyst upgrades after the firm disclosed second-quarter updates.The firm said its first five commercial satellites are on target for dedicated orbital launch in the first half of September and that it has secured FCC approval with initial license for the launch.

The company had stated that a strategic investment by Verizon has brought $100 million worth of financial commitment, that includes $65 million of commercial prepayments and $35 million of convertible notes.

Following the announcements, B. Riley Securities reportedly maintained a ‘Buy’ rating on the stock while raising the price target to $26 from $15. UBS, too, maintained its ‘Buy’ rating on the stock while increasing the price target to $30 from $13.

The stock has witnessed a significant rally since mid-May when it crossed above its 200-daily moving average for the first time since Nov. 2023. From about $4 a share, the stock rallied to a high of about $39 in mid-August before paring some of the gains. Some Stocktwits users believe the stock may hit the 20s in the coming times.

Also See: Chewy Stock Rises 5% After Q2 Net Income Jumps 14x: Retail Goes Crazy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)