Advertisement|Remove ads.

Retail Bullish On AT&T Despite $13M Settlement With FCC: Investors Focused On Stock's Crucial Break-Out

AT&T Inc (T) shares were trading in the red on Tuesday after the Federal Communications Commission (FCC) announced a $13 million settlement with the firm.

According to the FCC, the settlement pertains to resolving an Enforcement Bureau investigation into the company’s supply chain integrity and whether it failed to protect the information of AT&T customers in connection with a data breach of a vendor’s cloud environment.

FCC pointed out that AT&T used the vendor to generate and host personalized video content for AT&T customers. Under AT&T’s contracts, the vendor should have destroyed or returned AT&T customer information when no longer necessary to fulfill contractual obligations.

However, the company failed to ensure that the vendor adequately protected the customer information, and also did not ascertain whether the vendor returned or destroyed it as required by contract. In January 2023, threat actors exfiltrated AT&T customer information from the vendor’s cloud environment, FCC noted.

AT&T has entered into a Consent Decree that commits to strengthening its data governance practices to increase its supply chain integrity and ensure appropriate processes and procedures.

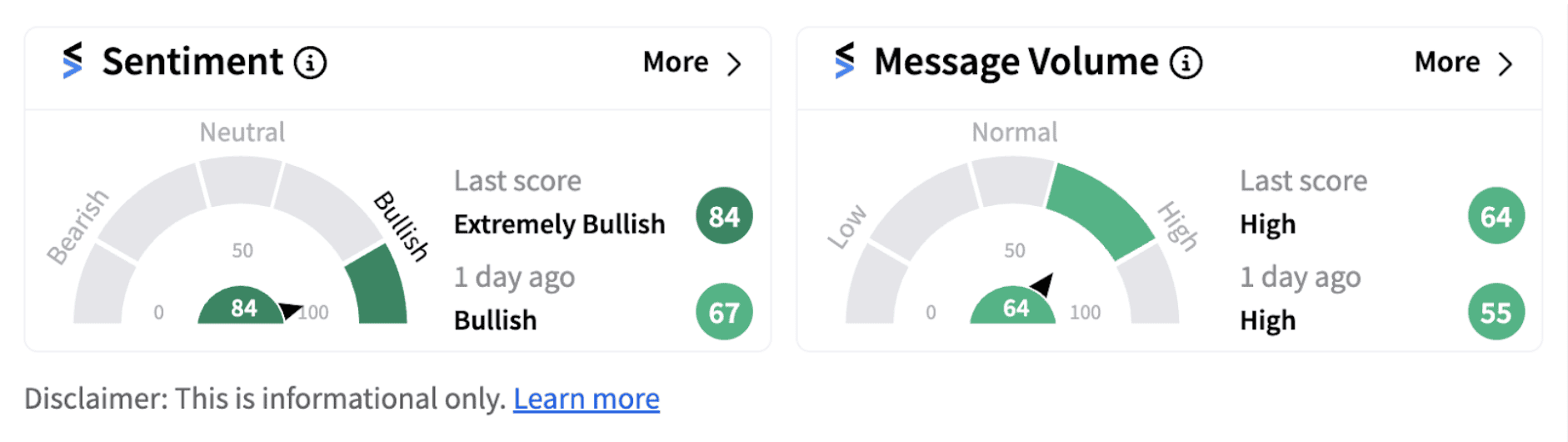

Although AT&T shares fell nearly 2% on Tuesday, Stocktwits followers of the ticker were displaying exuberance about the stock’s near term performance.

The stock recently broke out above a crucial resistance level near the $21.50 level to hit a three-year high.

Some Stocktwits users believe potential rate cuts in the coming times will provide a decent boost to the stock.

Some expect the stock to skyrocket in the near term.

CEO John Stankey recently stated at the Goldman Sachs Communacopia + Technology Conference that the company remains confident in its ability to deliver on all of the consolidated financial guidance shared during its earnings report in July 2024.

AT&T continues to expect 2024 capital investment in the $21-22 billion range and said it is on track to achieve net-debt to adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) in the 2.5x range in the first half of 2025.

AT&T shares have gained nearly 27% on a year-to-date basis. Now that the stock has broken out above a crucial long-term resistance, investors will be waiting for the shares to cross the $25-mark in the near term.

Also See: Mullen Automotive Stock Slides 15% As 1-for-100 Reverse Split Kicks In: Retail Frustrated

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244475103_jpg_13c45a71c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_ed6fc0a54f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jim_Cramer_82051b390e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_I_Shares_25784fa2dc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_891861286_jpg_f5527520c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)