Advertisement|Remove ads.

Aurinia Stock Rallies On Upbeat Q1 Earnings, CEO Expects Strong Performance in 2025: Retail Sentiment Brightens

Shares of Aurinia Pharmaceuticals Inc. (AUPH) surged 3% in premarket trading on Monday after the company’s first-quarter (Q1) earnings topped Wall Street expectations.

The biopharmaceutical company reported a 24% year-on-year (YoY) jump in its first-quarter (Q1) total revenue to $62.5 million, surpassing an analyst estimate of $61.06 million, according to Finchat data.

The surge in revenue was primarily driven by a 25% YoY jump in net product sales of Lupkynis, the company’s FDA-approved oral therapy for treating adult patients with active lupus nephritis, to $60 million.

For the three months ending March 31, 2025, the company reported a net income of $23.3 million, compared to a loss of $10.7 million in 2024.

Diluted earnings per share came in at $0.16 for the quarter, compared to a loss of $0.07 per share recorded in the corresponding period of 2024, and above an analyst estimate of $0.1.

Aurinia ended the quarter with cash, cash equivalents, restricted cash, and investments of $312.9 million, compared to $358.5 million on Dec. 31, 2024.

CEO Peter Greenleaf said the company looks forward to a “strong performance” in 2025.

The firm also reiterated its full-year total revenue guidance of $250 million to $260 million and net product sales guidance of $240 million to $250 million.

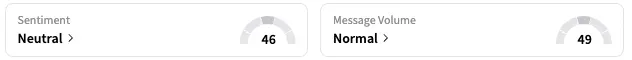

On Stocktwits, retail sentiment around Aurinia jumped from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume stayed at ‘normal’ levels.

AUPH stock is down by about 9% this year but up by over 59% over the past 12 months.

Also See: Expedia Retail Traders Remain Optimistic Despite Q1 Revenue Miss Ahead Of Holiday Travel Season

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)