Advertisement|Remove ads.

Relief Rally: Aurobindo Pharma Surges After Zentiva Twist; SEBI Analyst Recommends Short-Term Buy

Aurobindo Pharmaceuticals saw a relief rally on Thursday, with its shares rising over 5%. This comes after news reports indicated that private equity firm GTCR has struck a $4.8 billion deal to acquire Zentiva. Aurobindo was one of the contenders in this race for the Zentiva buyout.

Investors cheered this development as it dispels speculation that Aurobindo would incur substantial debt for the acquisition. Analysts had raised concerns about Aurobindo's possible high leverage if it had acquired Zentiva.

Additionally, visible short covering in the F&O market has further supported its upward movement. Aurobindo Pharma was among the top trending stocks on Stocktwits at 3 pm.

The Race For Zentiva

GTCR, a private equity firm, is reportedly close to finalizing a $4.8 billion agreement to acquire Zentiva, a Czech generic drug manufacturer, from Advent International. An official announcement is anticipated soon. Advent had acquired Zentiva from the French pharmaceutical giant Sanofi in 2018 for 1.9 billion euros.

In August, an Economic Times report stated that Aurobindo was in the race to acquire Zentiva for nearly $5.5 billion. However, Aurobindo, in a statement to exchanges, had responded saying they had not signed any binding agreements.

Analyst Take

Ashok Kumar Aggarwal highlighted that technical indicators show positive momentum, as the Relative Strength Index (RSI) is above 60 and the CMO (Chande Momentum Oscillator) is above 25. Both OBV (On Balance Volume) and PVT (Price Volume Trend) are showing an increase on the hourly and daily time frame charts, suggesting accumulation in the stock.

He recommended a short-term trade in Aurobindo, with accumulation at ₹1,102-₹1,110, for price targets of ₹1,190 and ₹1,250. Maintain a stop loss at ₹1,050.

What Is The Retail Mood?

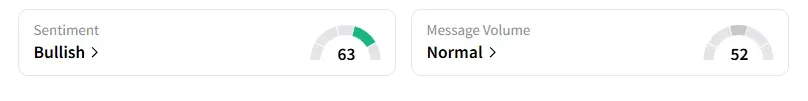

Data on Stocktwits shows that retail sentiment turned ‘bullish’ post this news development. It was ‘neutral’ ahead of this.

For the year so far, Aurobindo shares have declined 17%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)