Advertisement|Remove ads.

Autodesk, Hubspot, Atlassian: Macquarie’s Top Software Picks Into Earnings — Is Retail On Board Too?

The earnings growth of the S&P 500 companies is expected to drop to its slowest pace in more than a year, according to FactSet. The software sector’s earnings growth (13%) is likely to trail the overall IT industry’s estimated growth of 16.7%.

Macquarie analyst Steve Koenig said the second quarter could tell a different story from the first-quarter results, which were mostly solid across the board. The analyst noted that of the early reporters, SAP (SAP) announced a disappointing second-quarter outlook, while ServiceNow’s (NOW) results were solid across the board.

The analyst also noted that expectations may have ratcheted up due to a rebound in software and tech valuations over the last three months.

“We expect to see more companies citing global macroeconomic and/or policy uncertainties as reasons for adverse results or guidance,” he said.

“At the ever-present risk of swinging and missing,” Koenig flagged Autodesk (ADSK), HubSpot (HUBS) and Atlassian (TEAM) as his “ higher-confidence picks for the June/ July quarter prints.”

Autodesk: Koenig’s confidence stemmed from the fact that Autodesk stock has changed little from the time it reported its first-quarter results. The analyst also viewed the company’s guidance issued along with its first-quarter results as “prudent.”

Citing channel checks, the analyst said Autodesk’s new transaction model is progressing. He also sees a promising opportunity in applying artificial intelligence (AI) to generative design.

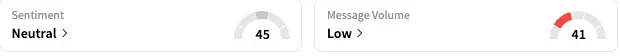

On Stocktwits, retail sentiment toward the stock shifted to ‘neutral’ (45/100) from a ‘bearish’ mood a day ago, with message volume at ‘low’ levels.

HubSpot: Koenig said he believes conditions are favorable for improved sentiment and price action for HubSpot stock after the company's June quarter results. The analyst highlighted several factors that could drive meaningful upside in 2025, including improvements in net expansion rates, a shift in pricing model, and a stronger focus on acquiring new large customers (those with 200+ employees).

Retail sentiment toward HubSpot remained ‘bearish’ (36/100) on Stocktwits, deteriorating from the ‘bullish’ sentiment observed a month ago. The message volume on the stream was ‘normal.’

Atlassian: Macquarie sees Atlassian stock as another strong candidate for mean reversion, given the recent negative sentiment and price action following an “untidy” March quarter report.

That said, the analyst expects the initial 2026 guidance to skew. However, initial FY26E guidance could be skewed downward from consensus, presenting a potential risk factor for the stock.

Koenig expects solid fourth-quarter results, driven by an intense management focus on executing large deals to close out fiscal year 2025.

On Stocktwits, sentiment toward Atlassian stock was ‘bearish’ (38/100) compared to a ‘neutral’ mood seen a week ago. The message volume stayed at ‘normal’ levels.

For the year-to-date period, Autodesk shares were up 2.6%, while HubSpot and Atlassian have lost about 20% and 17%, respectively. The SPDR S&P Software & Services ETF has gained a little over 2% during the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)