Advertisement|Remove ads.

Eli Lilly Stock Rises After Hours On UBS ‘Buy’ Call Ahead Of Oral Obesity Pill Launch — GLP-1 Battle With Novo Heats Up

- UBS initiated coverage with a ‘Buy’ rating and set a $1,250 price target, citing confidence in Lilly’s obesity execution.

- The firm said it sees a clear path to obesity-driven growth beyond 2026, with upside to estimates from the franchise.

- UBS said investors can buy the stock ahead of the oral obesity pill launch, which it believes could occur sooner than expected.

Eli Lilly shares rose in after-hours trading on Tuesday after UBS assumed coverage of the drugmaker with a ‘Buy’ rating, urging investors to accumulate the stock ahead of the expected launch of its oral obesity pill, Orforglipron, as competition in the GLP-1 market intensifies.

UBS Backs Lilly Ahead Of Orforglipron Launch

UBS analyst Michael Yee initiated coverage with a ‘Buy’ rating and set a $1,250 price target, up from $1,080, which implies a 17% upside from the stock’s last close. The firm said its positive stance is supported by Lilly’s continued execution and leadership in obesity.

The brokerage added that it sees a clear path to obesity-driven growth beyond 2026 and upside to estimates from the obesity franchise, saying investors can buy the stock ahead of the Orforglipron launch, which it believes could happen sooner than expected.

Oral Obesity Drugs Gain Traction

Lilly is best known for its injectable weight-loss drug Zepbound, but oral obesity pills are widely seen as the next major driver in the category, given their easier administration. Lilly is targeting approval of Orforglipron by early 2026. In a study, the oral drug helped patients lose an average of 12.4% of body weight at the highest dose over 72 weeks.

Deals To Strengthen Oral Pipeline

Alongside its internal pipeline, Lilly has stepped up dealmaking to bolster its push into oral obesity and metabolic drugs. The company recently signed a multi-year partnership with Nimbus Therapeutics to develop new oral treatments using AI, with Nimbus eligible for $55 million in upfront and near-term milestones and up to $1.3 billion in total milestone payments, plus tiered royalties.

Separately, The Wall Street Journal reported that Lilly is in advanced talks to acquire Ventyx Biosciences for more than $1 billion. Ventyx develops oral therapies for inflammatory and obesity-linked cardiovascular and neurodegenerative conditions.

GLP-1 Rivalry With Novo Nordisk Intensifies

The UBS note comes as competition with Novo Nordisk heats up following Novo’s U.S. launch of an FDA-approved oral Wegovy pill. Novo said U.S. customers can access the pill starting at $149 a month for lower doses, with some commercially insured patients paying as little as $25 per month. Prices rise to $199 a month for certain doses from April 2026, while higher doses are priced at $299.

Novo’s move marked the first oral GLP-1 weight-loss drug to reach the U.S. market and added pricing pressure across the category.

How Did Stocktwits Users React?

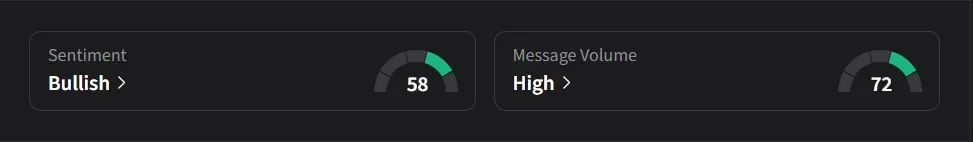

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user questioned Lilly’s deal with Nimbus, suggesting it could indicate delays or challenges with Lilly’s own pill program, calling the move a potential setback.

Another user said Lilly was “Taking on too much leverage. This will turn into pfizer 2.0”

Lilly’s stock has risen 37% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)