Advertisement|Remove ads.

B. Riley Retail Traders Eye Short Covering As Next Key Catalyst After Nasdaq Compliance Win

B. Riley stock (RILY) stock gained 3.2% in aftermarket trade on Wednesday after jumping more than 35% in the regular trading session.

On Tuesday, the company said it received a notice from Nasdaq that it had regained listing compliance.

On Friday, the company filed its delayed third-quarter earnings report with the Securities and Exchange Commission to gain compliance with listing rules.

Earlier this week, the company said that it would release preliminary fourth-quarter financial results after the bell in March.

“We look forward to providing investors with a broader update when we host a conference call next Monday. At that time, we will provide a comprehensive picture of our business and our priorities for the coming year,” Co-CEO Bryant Riley had said.

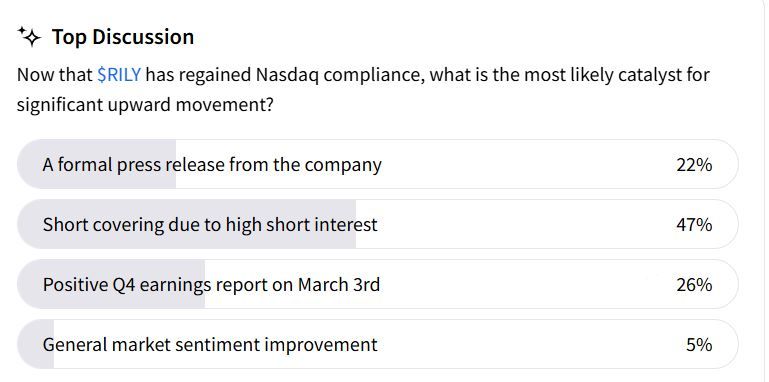

In a Stocktwits poll, 47% of the respondents said that “short covering due to high short interest” would likely drive significant upward movement. In comparison, 26% voted for a positive Q4 earnings report and 22% voted for a formal press release to be the catalysts.

According to Koyfin data, the company had a short interest of 28.2%. Over the past week, retail chatter surrounding the stock has grown more than 367%.

One user said that the stock’s option markets indicated it would reach $7 or higher by the end of the week.

Another user said that a short squeeze is imminent.

The company also said last week that it had sufficient cash to meet its working capital and capital expenditures for the coming year.

B. Riley stock has been pressured by multiple failures to meet quarterly earnings report filing deadlines, rising debt, and its inability to post a profit in several years.

Over the past 12 months, the stock has fallen 64%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)