Advertisement|Remove ads.

Chevron In Spotlight After US Rescinds License To Export Oil From Venezuela, Retail Sits On The Fence

Chevron (CVX) stock was on retail traders’ radar on Wednesday after U.S. President Donald Trump said his administration would revoke an agreement that allowed the company to produce and export oil from Venezuela.

In a post on the Truth Social platform, Trump said that the U.S. would be ‘reversing the concessions’ given to Venezuelan President Nicolas Maduro under the ‘oil transaction agreement’ from Nov. 26, 2022.

Though the U.S. President did not mention Chevron in the post, the company was the only one to receive a license from the Biden administration to operate in the country on that date.

Trump said that the decision was taken as electoral conditions of the license had not been met by Maduro, who began a third term as president in January despite allegations of fraud in the election held last year. He also alleged that the country failed to bring back ‘violent criminals’ from the U.S.

“The United States government has made a damaging and inexplicable decision by announcing sanctions against the U.S. company Chevron. In its attempt to harm the Venezuelan people, it is, in fact, hurting the United States, its population, and its companies,” Venezuela’s Vice President Delcy Rodriguez said in a statement.

According to a Reuters report, Chevron exported 294,000 barrels per day from Venezuela in January.

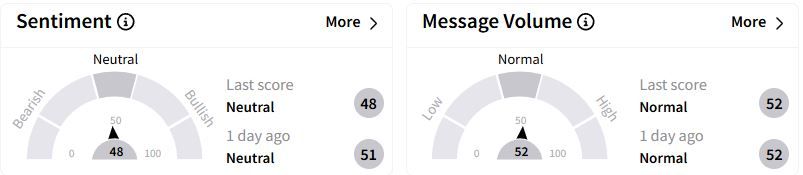

Retail sentiment on Stocktwits remained in the ‘neutral’ (48/100) territory, while retail chatter was ‘normal.’

Earlier this week, the company announced several leadership changes and segment consolidation in an attempt to simplify its organizational structure.

The company had said earlier in February it would lay off between 15% and 20% of its workforce to cut costs.

Chevron’s oil reserves have receded to their lowest point, at least in a decade. However, the company has been able to ramp up production in the Permian basin and has started an expansion project in Kazakhstan’s Tengiz oilfield.

Over the past year, Chevron stock has gained marginally.

Also See: Kratos Defense & Security Stock Falls After Tepid Q1 Outlook, Retail Clings On To ‘Iron Dome’ Hopes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)