Advertisement|Remove ads.

B. Riley Soars 20% After Oaktree Capital Acquires Great American, Retail Sentiment Turns ‘Extremely Bullish’

Shares of B. Riley Financial Inc (RILY) climbed 20% after the investment bank announced that it will sell its appraisal and valuations division Great American to asset manager Oaktree Capital for almost $400 million.

The deal will see B. Riley pocket about $203 million in cash, along with $183 million in Class B preferred units of the new holding company for Great American, plus a 47% stake in the new Class A equity. Both companies' boards have given the green light to the transaction, which is expected to close in the fourth quarter.

Bryant Riley, chairman and co-CEO of B. Riley, expressed confidence that Oaktree's scale and expertise in alternative investments would complement Great American’s role in asset disposition, financial advisory, and real estate services.

Great American conducts appraisal, valuation and liquidation work for distressed companies and has been part of B. Riley since 2014.

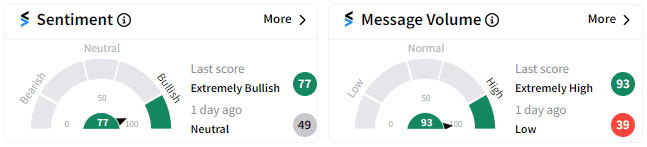

Retail sentiment on Stocktwits soared into the ‘extremely bullish’ zone (77/100) from ‘neutral’ a day earlier, and chatter about the stock skyrocketed to ‘extremely high’ (93/100).

B. Riley’s stock has declined 79% in 2024 so far, with bulk of the fall coming in August after the bank announced it was suspending its dividend partly because of the fallout from a loan it provided to help the former chief executive of Franchise Group Inc., Brian Kahn, acquire that company last year.

Investor sentiment eroded after the bank disclosed it had been subpoenaed by the SEC in July as part of the ongoing investigation into Kahn. While the bank insists that the allegations against Kahn, particularly concerning his alleged misconduct at the hedge fund Prophecy Asset Management, are unrelated to B. Riley or Franchise Group, the situation has created “additional challenges for this investment,” according to the firm.

Franchise Group’s retail brands include Vitamin Shoppe, Pet Supplies Plus and furniture company American Freight. It sold Sylvan Learning to Unleashed Brands earlier this year. It also sold Badcock Furniture to Conn’s.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)