Advertisement|Remove ads.

Backblaze Stock Surges Aftermarket On Q4 Earnings Beat Driven By Productivity Improvements, AI Business Traction: Retail Sentiment Soars

Shares of Backblaze Inc. (BLZE) surged more than 7% during after-market trading on Tuesday after the company’s fourth-quarter results surpassed Wall Street expectations.

Backblaze reported a loss per share of $0.06 during Q4, slightly better than estimates of a loss of $0.09 per share. This compares favorably, with the loss per share narrowing from $0.15 a year earlier.

Backblaze’s topline was better than expectations – it posted revenue of $33.79 million, edging past the estimated $33.73 million.

The company reported upbeat performance in its B2 Cloud Storage segment, which grew 22% year-on-year (YoY) to $17.1 million in Q4, accounting for over 50% of its topline.

For the full year 2024, Backblaze’s revenue rose 25% YoY to $127.6 million, with the B2 Cloud Storage segment driving the growth with a surge of 36%.

"Not only did we increase sales productivity and won an over $1 million annual contract value (ACV) customer in the quarter, we also saw AI starting to meaningfully contribute to the business, with 3 AI companies now in our top 10 customers in December 2024,” said CEO Gleb Budman.

For fiscal year 2025, Backblaze forecast revenue of $144 million to $146 million, slightly lower than estimates of $146.29 million.

According to The Fly, analysts at B. Riley lowered their price target for the Backblaze stock to $11 from $11.50 last week, implying an upside of nearly 74% from current levels. The brokerage has a ‘Buy’ rating on the stock.

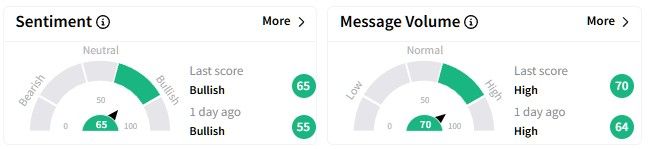

On Stocktwits, retail sentiment around the Backblaze stock soared into the ‘bullish’ (65/100) territory, accompanied by a rise in message volume.

One user underscored their bullish outlook for the stock, calling it a “solid buy.”

Backblaze’s shares have seen a sideways movement recently, declining by 2.8% in the last six months. However, the stock’s one-year performance is far worse, with a fall of over 36%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_japan_jpg_5a4a8c1f81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931078_jpg_7ccfff654b.webp)