Advertisement|Remove ads.

First Solar Projects Brighter 2025 After Mixed Q4, Stock Climbs After-Hours: Retail Stands Firmly Bullish

Shares of First Solar Inc. (FSLR) gained over 1.7% in after-market hours, as the company’s 2025 guidance pointed to a surge in earnings, even though its fourth-quarter results were mixed.

First Solar posted earnings per share (EPS) of $3.65, falling short of Wall Street expectations of $4.63. Last year, First Solar’s EPS stood at $3.25 in the same period.

The company posted revenue of $1.51 billion, edging past expectations of $1.48 billion and rising from $1.16 billion during the same period last year.

The company said that driving the revenue growth during Q4 was higher sales of solar modules.

For 2024, First Solar’s EPS stood at $12.02, short of an estimated $12.78. Full-year revenue stood at $4.21 billion, beating an expected $4.18 billion.

For the fiscal year 2025, First Solar guided for an EPS in the $17-$20 range, slightly lower than Wall Street’s expectations of $20.70. However, at a mid-point of $18.50, it is still more than 50% higher than the company’s 2024 EPS.

“Even as we maintained a highly selective approach to bookings, we expanded manufacturing capacity by commissioning our Alabama facility and progressed construction of our new Louisiana facility,” said CEO Mark Widmar, adding that a new research and development center has been established in Ohio.

“The biggest thing this industry needs, and you can pretty much talk to anyone in this industry, is just the certainty of how to move forward, and we don't have that clarity right now,” he added.

Data from FinChat shows the average price target of 41 brokerage recommendations for First Solar is $266.76, implying an upside of over 74% from current levels.

Of these, there are 22 ‘Buy,’ and 13 ‘Outperform’ ratings, five recommendations of ‘Hold,’ and one brokerage has ‘No Opinion.’

Earlier, analysts at Mizuho underscored that while the Trump administration could end the solar tax credits program, tariffs could offset some of the impact.

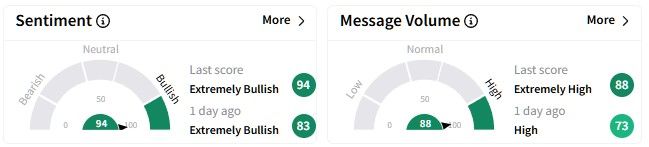

Retail sentiment on Stocktwits around the First Solar stock remained in the ‘extremely bullish’ (94/100) territory, soaring from a day ago.

Message volume was also in the ‘extremely high’ levels as retail investors weighed in on the company’s Q4 performance.

One user commented on First Solar’s 2025 forecast, saying the stock “deserves” to go higher.

First Solar’s stock has been on a downtrend over the past six months, losing nearly 37% of its value. However, over a one-year period, it is up 2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Twilio Stock Selloff Overdone, Says Morgan Stanley With An Upgrade — But Retail Disagrees

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)