Advertisement|Remove ads.

Bajaj Finance MD Resigns Ahead Of Q1 Earnings: SEBI RAs Signal Bullish Setup, Buy-On-Dip Opportunity

Bajaj Finance is in the spotlight after Anup Kumar Saha resigned as Managing Director, just four months after his appointment. The Pune-based NBFC announced the appointment of Rajeev Jain to the role till March 31, 2028.

The company is also scheduled to report its Q1 FY26 earnings on July 24.

According to reports, the non-banking financial services company is expected to post strong double-digit growth in Q1FY26, with NII rising 27% and net profit increasing 19%, driven by healthy loan growth and lower credit costs.

At the time of writing, Bajaj Finance shares were up 0.8% at ₹956.15.

Technical Outlook

Technically, the stock is set up for near-term upside. On the hourly chart, Bajaj Finance has staged a strong rebound after consolidating near the ₹920 zone, said SEBI-registered analyst Deepak Pal.

It has currently breached the resistance level of ₹943 - ₹945, which aligns with the 200-day exponential moving average (EMA), a level that often acts as a trendsetter in short-term trades.

The Parabolic SAR has flipped below the price, supporting a short-term bullish bias. Meanwhile, the moving average convergence/divergence (MACD) is in a positive crossover and strengthening gradually. The relative strength index (RSI) stands at 65.26, indicating rising momentum with further buying headroom.

Ahead of Q1 results, speculative buying appears to be underway, Pal noted. A sustained breakout above ₹950 could trigger a rally toward the ₹970 - ₹990 range. On the downside, the ₹928 - ₹930 zone serves as immediate support and could offer a buy-on-dip opportunity, he added.

The broader structure on daily and weekly charts remains bullish, with ₹900 acting as a major support zone. If momentum sustains post-earnings, Bajaj Finance could head toward the psychological ₹1,000 mark in the near term, Pal said.

According to SEBI RA Prameela Balakkala, the stock continues to trade within a strong ascending channel, indicating a healthy medium-term uptrend. It is currently in the middle-to-lower half of the channel, hinting at a minor pullback but still within trend support.

She sees immediate support at ₹930, while the major demand zone lies between ₹810 and ₹840, aligning with the previous consolidation. On the upside, resistance is expected near ₹960 –₹980, which marks the channel top and prior swing highs.

Volume has been declining, indicating a possible consolidation phase. The Average Directional Index (ADX) stands at 18.5, reflecting weak trend strength. However, unless the shares close below ₹813, the broader trend remains bullish.

Balakkala also recommended buying dips near the demand zone.

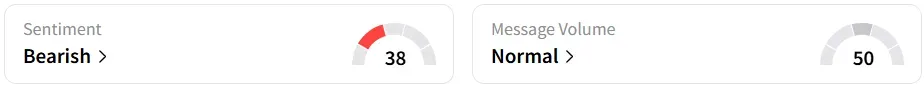

Retail sentiment on Stocktwits remains ‘bearish’.

Year-to-date (YTD), Bajaj Finance shares have gained 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Express_resized_d6044f410d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_axsome_resized_jpg_09f7c99fb1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)