Advertisement|Remove ads.

Bandhan Bank’s Technicals Turn Bullish Ahead Of Q2 Results: Analyst Explains Why

- Bandhan Bank is on the verge of a trend reversal after years of underperformance.

- The lender is set to report Q2 results on October 30

- A clean breakout and improving indicators could make the next two quarters surprisingly strong.

Bandhan Bank shares are finally showing signs of life after being stuck in a multi-year downtrend. The Kolkata-based universal bank is gearing up for its September quarter (Q2 FY26) earnings report on October 30. The stock has gained 6% in the last five sessions.

With a clean breakout, rising momentum, and accumulation signs, the next two quarters could surprise positively, especially with a significant earnings catalyst right around the corner, according to SEBI-registered analyst Rajneesh Sharma.

Trend Reversal In Motion?

Sharma highlighted that since 2020, Bandhan Bank has been trapped inside a falling channel of a classic lower highs, lower lows structure. But recently, the stock broke out above the channel's resistance trendline. It is considered as a strong sign because it flipped its resistance into support and formed a higher low around ₹145–150, which is a clear shift from the previous trend.

He cited a breakout and a higher low as signaling the beginning of a new trend. Additionally, it is now reclaiming the 23.6% retracement level (₹179), and if it continues to hold this level, it would mean that the downtrend might be losing its grip.

Bullish Technical Indicators

Other technical indicators, such as the MACD line, has crossed above the signal line, which is a classic bullish crossover. This indicated that the omentum is shifting. Earlier sellers are either exiting or turning buyers, according to Sharma.

Also, the Relative Strength Index (RSI) has climbed from the oversold zone (~30) to above 50, adding credibility to reversals. Add to this that the OBV (On Balance Volume) is forming a rounded bottom. It indicates accumulation, suggesting that volume is flowing in even when the price is range-bound.

Some Caution Is Warranted

However, Sharma cautioned that this bullish view holds only as long as Bandhan Bank stock stays above ₹150–155. A break below ₹135 would invalidate the current bullish setup. He concluded that with improving technicals and a major earnings update around the corner, the chart setup looks increasingly interesting for the next two quarters. Sharma advised traders to monitor this chart closely.

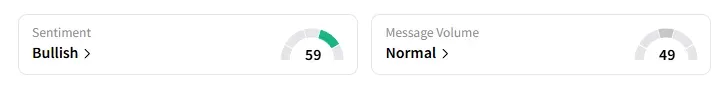

What Is The Retail Mood On Stocktwits?

Data on Stocktwits showed that retail sentiment has been ‘bullish’ for a week on this counter.

Bandhan Bank shares have risen 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)