Advertisement|Remove ads.

Bank Of America CFO Says Fed Winning Battle Against Inflation: But Bond Market Has A Different Take

Bank of America CFO Alastair Borthwick has reportedly said the Federal Reserve is winning its battle against inflation.

"The Fed winning the inflation battle is important for the economy. It appears they are winning that battle," Borthwick said at a conference, according to a Reuters report.

The comments follow a larger-than-expected 50 basis points rate cut by the central bank for the first time in four years, intended at tackling a weak economy.

"We're back now to something more akin to a low growth, low inflation and potentially reasonable rate structure that should make it a pretty good environment for American banks," Borthwick said while praising the central bank’s efforts to trim down the "Basel Endgame" proposals.

However, certain corners of Wall Street possess a divergent view on inflation. For instance, longer-dated treasury yields, which are the most sensitive to inflation outlook, have risen to the highest levels since early September, according to Reuters.

This is a clear signal from the bond market that the apex bank’s shift in focus from reducing inflation to protecting the job market may lead to a rebound in price pressures.

Interestingly, Federal Reserve Governor Michelle Bowman, who was the lone dissenter at the Federal Open Market Committee’s latest policy meet, said on Tuesday she is concerned about inflation and her colleagues should have taken a more measured approach to the 50 basis points rate cut.

Bowman believes the half percentage point rate cut may not be conducive to the central bank’s goals of low inflation and full employment.

The massive rate reduction “could be interpreted as a premature declaration of victory on our price-stability mandate. Accomplishing our mission of returning to low and stable inflation at our 2% goal is necessary to foster a strong labor market and an economy that works for everyone in the longer term,” Bowman told a bankers group in Kentucky.

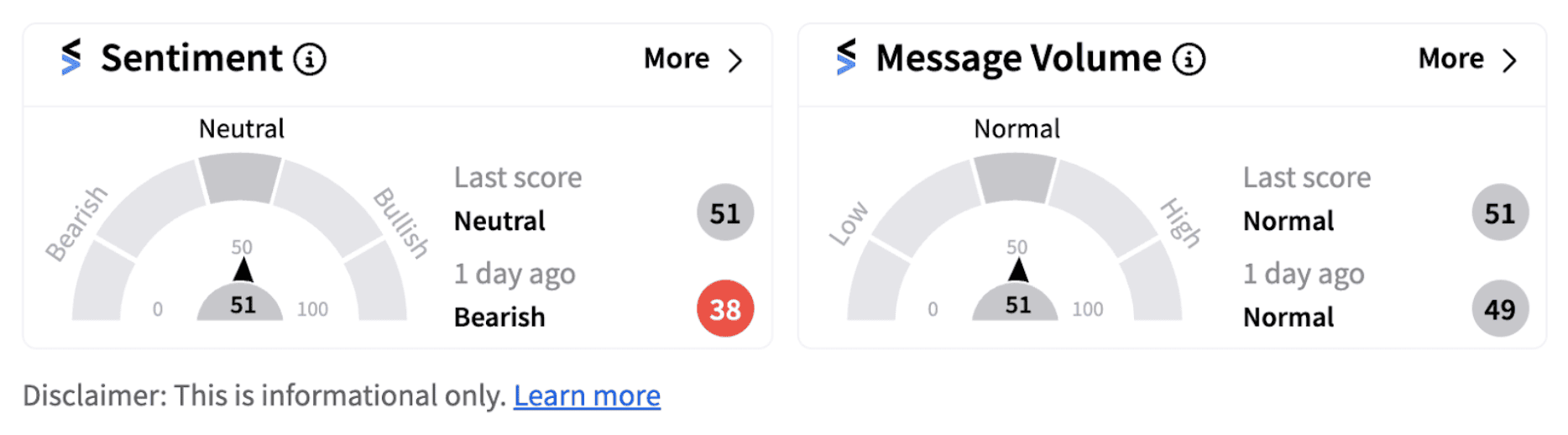

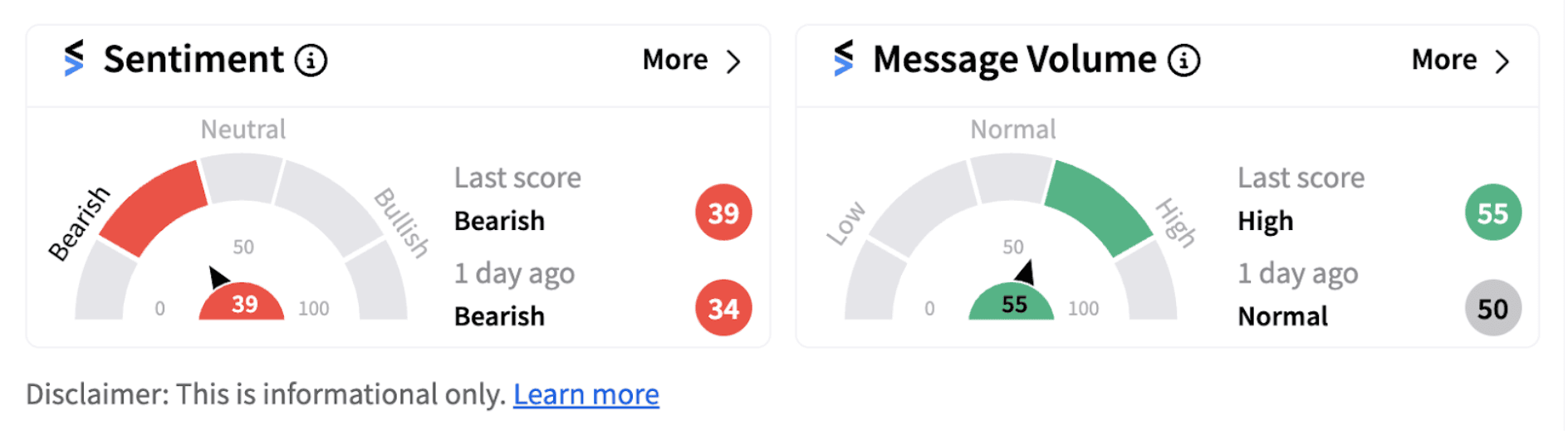

The question is will the Fed’s 50 basis points rate cut prevent the economy from going into recession or has the central bank been a bit late in its response. Some of this confusion appears to have trickled down into investor sentiments as well.

Some Stocktwits users believe inflation will not subside so easily despite the 50 bps cut.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)