Advertisement|Remove ads.

Barclays Downgrades CoreWeave On Valuation Concerns, But Stock Continues To Hit Fresh Highs: Retail’s Thrilled

Barclays analyst Raimo Lenschow downgraded CoreWeave Inc. (CRWV) stock to ‘Equal Weight’ from ‘Overweight’, citing high valuation and limited short-term upside.

According to TheFly, Lenschow revised the company’s price target to $100 from $70. Despite the downgrade, shares of the AI-focused cloud infrastructure provider traded over 13% higher on Tuesday morning to hit a fresh high of $116.95.

The stock has experienced a significant surge in price following its initial public offering (IPO) in March 2025.

The company, which priced its IPO at $40 per share, has seen its stock more than double, reaching approximately $102.74 per share as of May 27, 2025.

The analyst noted that CoreWeave's valuation has become challenging to justify, especially given the absence of close comparable peers in the AI infrastructure sector.

CoreWeave's strong performance is partly attributed to its strategic partnerships, notably with Nvidia, which owns approximately 7% of the company.

The firm leases Nvidia's graphics processing units (GPUs) to power AI workloads, positioning itself as a key player in the AI cloud infrastructure market.

Additionally, CoreWeave has secured significant contracts with major clients, including OpenAI and Microsoft, further solidifying its market position.

In the first quarter of 2025, CoreWeave reported a remarkable 420% year-over-year revenue growth, reaching $981 million.

For the second quarter, Coreweave projected sales of $1.06 billion to $1.1 billion, guiding for an adjusted operating income between $140 million and $170 million.

Despite this impressive growth, the company faces challenges, including high debt levels and the need for substantial capital expenditures to expand its infrastructure, said a CNBC report.

The analyst remains optimistic about CoreWeave's long-term prospects, but cautions that the current valuation may not be sustainable without continued strong performance and strategic execution.

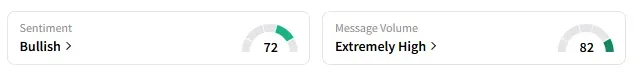

On Stocktwits, sentiment around CoreWeave turned to ‘bullish’ from ‘extremely bullish’ the previous day.

A Stocktwits user expects the shares to hit $120 on Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)