Advertisement|Remove ads.

Barclays Initiates Incyte With Overweight Rating, $90 Price Target, Retail Finds Reason To Cheer

Barclays has initiated coverage of Incyte (INCY) with an ‘Overweight’ rating and a $90 price target on Friday.

The price target implies an over 20% upside to the stock’s closing price on Thursday.

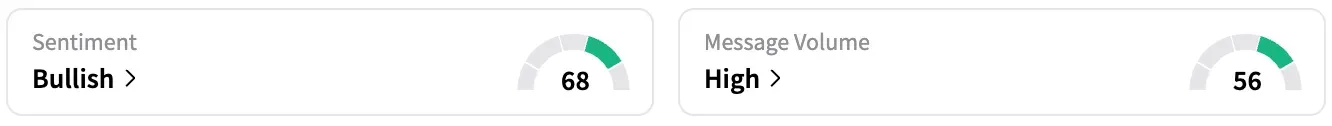

Shares of the company traded about 0.4% higher on Friday afternoon at the time of writing. On Stocktwits, retail sentiment around INCY trended in the ‘bullish’ territory, accompanied by ‘high’ message volume.

The firm said that it sees "value-inflecting" data readouts for the pharmaceutical company in the second half of 2025 and 2026.

It believes the pivotal data for Tafasitamab in diffuse large B-cell lymphoma and the mid-stage data for Povorcitinib in chronic spontaneous urticaria patients provide the next legs of growth for Incyte.

Earlier this week, Incyte said during its second-quarter earnings that it now expects late-stage data from the study evaluating Tafasitamab as a first-line treatment for diffuse large B-cell lymphoma by the second half of 2025. Incyte is now focusing on its development pipeline as its cancer drug, Jakafi, nears patent expiration.

“Continued progress and diversification of our portfolio, including advancements with povorcitinib and mutCALR, are strengthening the foundation for sustainable, long-term growth,” CEO Bill Meury said.

Jakafi net revenue came in at $764 million in the second quarter of the year, marking a growth of 8% year-on-year, and accounting for about 63% of the company’s total revenue in the quarter of $1.216 billion, which surpassed Wall Street expectations.

For the full year, the company is eyeing revenue of $3 billion to $3.5 billion from Jakafi.

Another important drug from the company is its Opzelura cream, used to treat nonsegmental vitiligo, which brought in revenues of $164 million in the second quarter, marking a growth of 35% year-on-year.

Overall, for the second quarter, the company reported an adjusted and diluted earnings per share of $1.57, compared to a loss per share of $1.82 reported in the corresponding period of 2024.

According to data from Koyfin, 11 of 27 analysts covering the stock rate it ‘Buy’ or higher, while 15 rate it ‘Hold’, and just one rates it a ‘Sell’. The average price target on the stock is $79.87, representing an upside of about 6% from the current price.

The stock is up by over 9% this year and by about 17% over the past 12 months.

Read also: Pheton Holdings Dismisses Rumors Of Acquisition By Gilead, But Retail’s Extremely Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ELF_Beauty_unsplash_056135126b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_logo_OG_jpg_b2a06ae10a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mcdonalds_store_jpg_130260f7da.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)