Advertisement|Remove ads.

Bargain Hunting Among Beaten-Down Megacaps? This Mag 7 Stock Looks Like The Best Deal On The Rack

- Meta’s recent earnings disappointment, questions over its capital expenditure, and AI bubble fears have pushed the stock into bear territory.

- Meta trades at a very affordable 20x NTM EPS.

- Apart from Alphabet, Apple is the only Mag 7 in the green this month, but it's barely up.

The tech sell-off in November has rendered valuations for several high-profile, megacap stocks attractive, making them bargain buys at current levels.

The Roundhill Magnificent Seven ETF (MAGS), which tracks the Magnificent Seven stocks, is down nearly 7% in November, worse than the SPDR S&P 500 ETF (SPY)’s 3.4% drop. The MAGS ETF’s year-to-date (YTD) gain of 16.6%, however, better than SPY’s 13.4% advance.

Here’s a look at the relative attractiveness based on three metrics, namely

- forward price/earnings (P/E) multiple

- price/earnings growth (PEG) growth ratio

- upside potential versus the average price target.

The P/E ratio is the classical method to compare valuations. P/E calculated on a forward basis is obtained by dividing a security’s market price by the company’s next-twelve-month (NTM) earnings per share (EPS). The PEG ratio compares a P/E ratio to expected earnings growth. A PEG ratio of 1 suggests the stock is fairly valued, and a reading above 1 indicates it is overvalued.

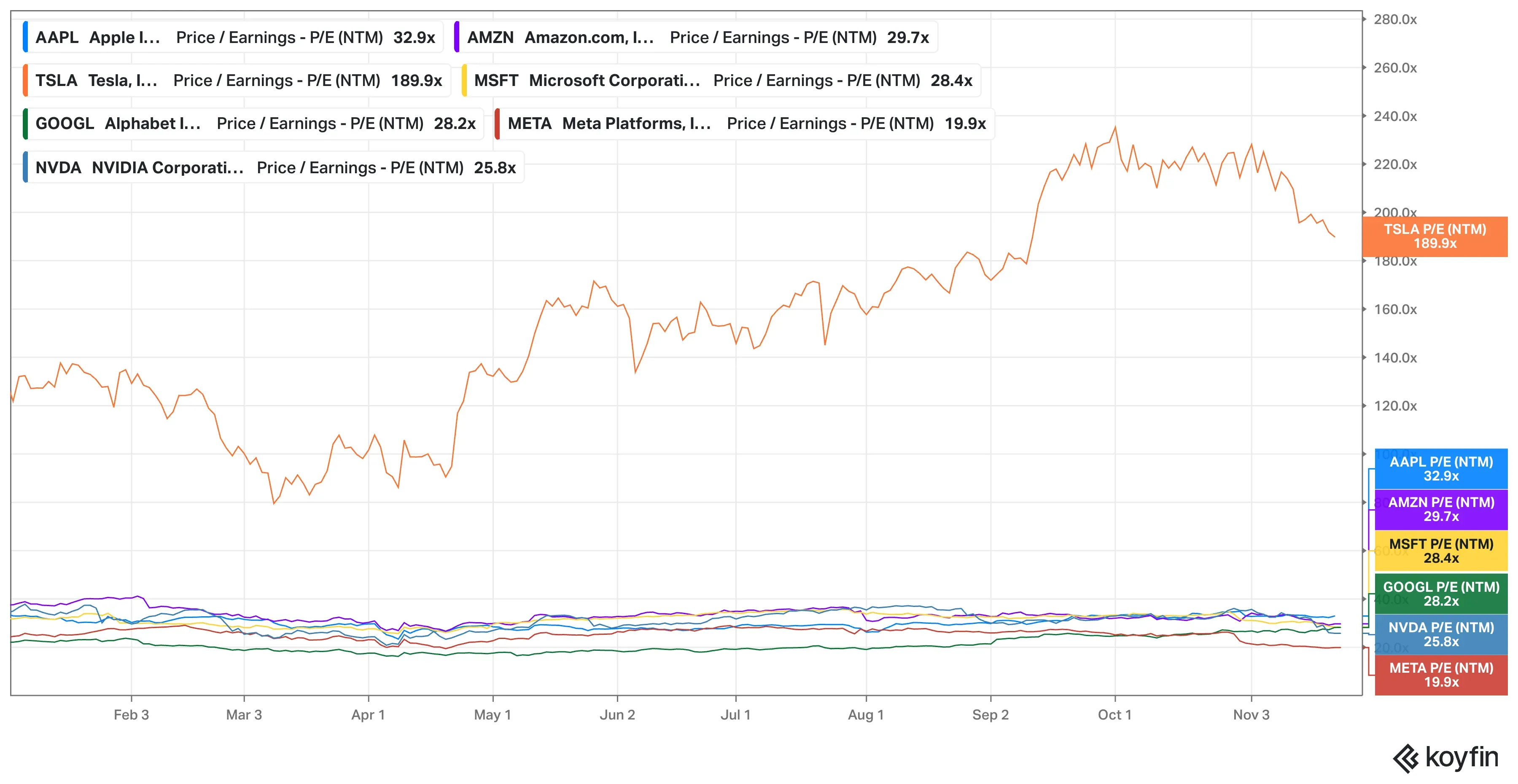

MAGS Forward P/E

Meta Platforms, Inc. (META) trades at a very affordable 20x NTM EPS. The social-media platform, led by Mark Zuckerberg, started the year on a solid footing. The recent earnings disappointment, questions over its capital expenditure, and AI bubble fears have pushed the stock into bear territory.

AI chip giant Nvidia Corp. (NVDA) is the second-most-attractive Mag 7 stock, with a forward P/E of 26, followed by Alphabet, Inc. (GOOGL) (GOOG) (28). The least attractive in the list is Elon Musk’s electric vehicle (EV) venture, Tesla, Inc. (TSLA). As Tesla’s fundamentals sour, the stock trades more on its potential opportunity presented by robotaxis, humanoid robots, and full self-driving (FSD) software suite.

Source: Koyfin

PEG Ratio

According to Yahoo Finance, the five-year expected PEG ratios of the Mag 7 companies are as follows:

-Nvidia: 0.68 times

- Meta: 1.64 times

-Alphabet: 1.69 times

-Amazon: 1.92 times

-Microsoft: 2 times

-Apple: 2.75 times

-Tesla: 7.76 times

Upside Potential

According to Koyfin, the consensus price targets and the upside potential from the last close are as follows:

-Meta: $842.12 (+41.7%)

-Nvidia: $247.50 (+38.4%)

-Amazon: $294.25 (+33.3%)

-Microsoft: $625.41 (+32.5%)

-Alphabet: $322.52 (+7.6%)

-Apple: $281.75 (+3.8%)

-Tesla: $392.93 (+0.5%)

Meta ticks most boxes in terms of stock attractiveness, primarily because of the recent drubbing it received. It could only take a quarter to come back strongly, and the recovery hinges on how the AI revolution unfolds and on the company’s AI market positioning vis-à-vis rivals.

Apple has the least exposure to AI among the Mag 7 companies, and therefore, its stock has fared relatively better since November. Apart from Alphabet, Apple is the only Mag 7 in the green this month, but it's barely up. Incidentally, the final three months of the year are typically the strongest performing months for the iPhone maker.

Alphabet, just because it has outperformed its peers, does not mean it is a stock to shun. As recently as Monday, the company’s Google Cloud announced a multi-million-dollar contract with the NATO Communication and Information Agency (NCIA) to deliver highly secure, sovereign cloud capabilities. The company’s Gemini large-language model has been eating into market leader ChatGPT’s market share.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_6d16fbaa7e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215606078_1_jpg_5239e96c89.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)