Advertisement|Remove ads.

Bath & Body Works Stock Rises On Analyst Upgrade Citing Innovation, Improving Home Fragrance Market: Retail Stays Bullish

Shares of Bath & Body Works (BBWI) rose more than 1% on Friday after the personal care products company received a ratings upgrade, lifting retail sentiment.

Citi upgraded Bath & Body Works from ‘Neutral’ to ‘Buy’ following the company’s post-Q4 earnings share sell-off, The Fly reported.

After several years of sales and margin declines, the second half of 2024 “inflected positively,” with the 2025 outlook expected to see a sales revival.

The firm also praised the company for strong execution, innovation efforts, and a more favorable home fragrance environment.

“We believe 1QTD trends are running above 1Q guidance, and expect a 1Q sales beat and strong margin flow-through to help allay investor fears (that are weighing on the multiple),” Investing.com reported citing Citi.

Separately, Baird also raised the firm's price target to $47 from $45 with an ‘Outperform’ rating. According to the firm, the company’s Q4 results indicated “a solid holiday season,” with the guidance containing room for an upside. The firm also predicted more buying in case of any share pullback.

Bath & Body Works recently reported a fourth-quarter earnings beat but said it could see a potential impact from China tariffs.

Its full-year 2025 earnings per diluted share is projected between $3.25 and $3.60, and adjusted earnings per diluted share of $3.29 in fiscal 2024, which compares to the consensus estimate of $3.26.

Its first-quarter 2025 earnings per diluted share is projected between $0.36 and $0.43, compared to $0.44 expected by analysts. Net sales, meanwhile, are forecast to grow between 1% and 3% compared to $1.38 billion in the first quarter of 2024.

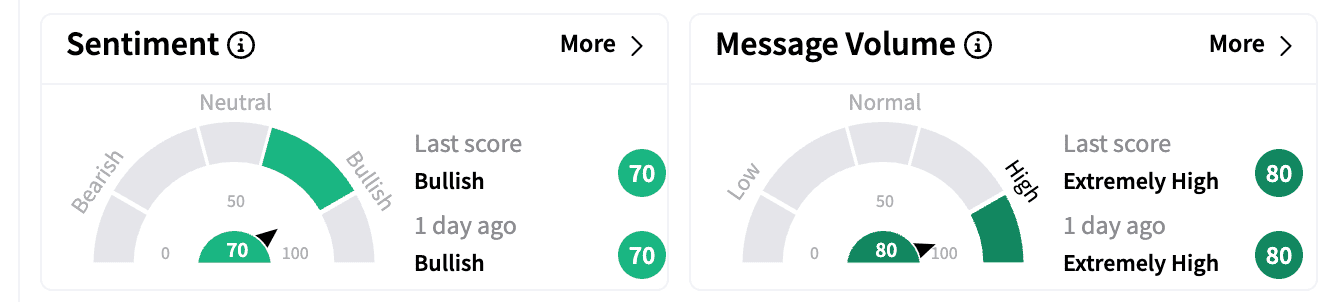

Sentiment on Stocktwits remained ‘bullish’ on Friday compared to a day ago. Message volume remained in the ‘extremely high’ zone.

Bath & Body Works stock is down 6.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)