Advertisement|Remove ads.

Bayer CropScience Shares May More Than Double In 5 Years: SEBI RA Finance With Palak

Bayer CropScience stock has the potential to rise toward ₹12,000 over the next five years, supported by long-term revenue growth and innovations in crop protection and digital farming technologies, according to SEBI-registered research firm Finance With Palak.

At the time of writing, Bayer CropScience shares were trading at ₹5,739.10, up ₹608.30 or 11.86% on the day.

In the short term, the firm expects the stock to reach ₹6,300–₹6,500, backed by ongoing revenue and profit momentum.

The research firm noted that over the medium term (1–2 years), the stock could rise to ₹7,500–₹7,600, with catalysts including increased adoption of sustainable agricultural practices and deeper penetration into emerging markets.

Bayer CropScience shares climbed by 11% after Q4 results due to strong investor interest following the company's disclosure of a 49.27% year-on-year quarterly net profit rise to ₹143.3 crore, paired with a 32% revenue growth from operations.

Finance With Palak said the stock shows key technical support between ₹5,500 and ₹5,600 while facing resistance between ₹5,800 and ₹5,900.

The stock's price stands at ₹5,740.90, with a market capitalization of ₹224.24 billion and a P/E ratio of 43.06.

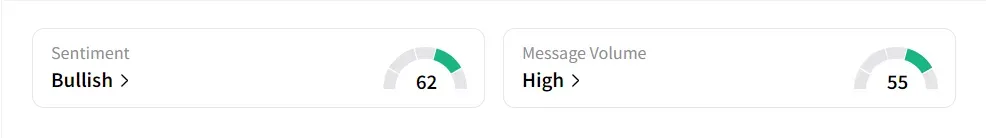

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

The stock has risen 3.7% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)